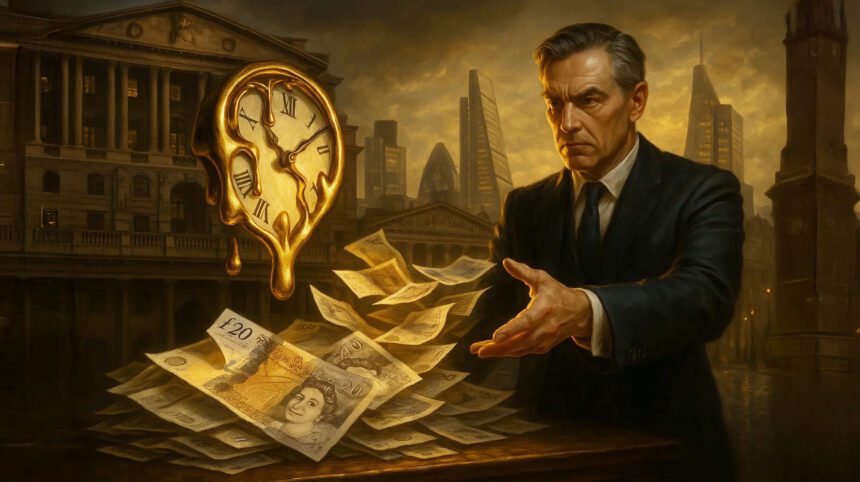

The Bank of England, on October 15, 2025, announced a major relaxation of banker bonus rules, cutting deferral periods and allowing faster payouts in a move aimed at boosting the competitiveness of the UK’s financial sector. The policy shift, introduced by the Bank’s Prudential Regulation Authority (PRA) in coordination with the Financial Conduct Authority (FCA), marks one of the most significant overhauls of post-financial crisis pay regulation since 2008.

Under the new framework, senior bankers will now see their bonus deferral period reduced from eight years to four years, with portions of bonuses allowed to vest earlier, sometimes as soon as the first year. Previously, bonuses were typically deferred for longer to ensure that any misconduct or poor performance could be penalized through “clawbacks.” Regulators have also modified how much of a bonus is subject to deferral, reducing the threshold to 60% of any amount exceeding £660,000, rather than the entire sum. Additionally, banks will now enjoy greater flexibility in determining how much of the deferred pay is delivered in cash versus shares or other instruments.

The regulators say the reforms are intended to “modernize” and “streamline” the pay structure to reflect global norms. The Bank of England argues that the old, more stringent rules had placed London at a disadvantage compared with rival financial hubs such as New York, Singapore, and Zurich, where deferral periods are generally shorter or even non-existent. By aligning with international standards, the authorities hope to help British banks attract and retain top talent in an increasingly competitive global financial landscape.

The changes take effect immediately and will apply to both upcoming and outstanding bonus awards for the 2025 financial year. The PRA estimates that these revisions will reduce the number of bankers subject to deferral rules by around 20%. Industry leaders have broadly welcomed the announcement, claiming it will restore flexibility and help London regain its appeal as a global finance center. Many executives view the move as a continuation of the UK’s broader post-Brexit efforts to free itself from rigid EU-era regulations that were introduced after the 2008 financial crash.

However, critics have voiced concerns that shorter deferral periods could weaken accountability in the banking sector. The long deferral windows were originally designed to discourage reckless risk-taking by ensuring that rewards were linked to sustainable, long-term performance. Reducing the waiting time, they argue, risks returning to a culture of short-term profit chasing. Some lawmakers and financial ethics groups have also warned that loosening pay restrictions could fuel public anger amid persistent cost-of-living pressures and economic inequality.

Despite these concerns, regulators emphasize that key safeguards will remain in place. The ability to claw back bonuses, reducing or reclaiming payouts in cases of misconduct, poor performance, or financial misstatement will still apply. The PRA insists the revised framework retains a “robust accountability structure” that balances fair reward with prudent oversight. Officials argue that the streamlined rules will not compromise stability but will rather make the UK more agile and responsive to evolving financial realities.

This policy shift follows an earlier landmark reform in 2023, when the UK scrapped the EU-imposed cap on banker bonuses, which had limited bonuses to twice the value of a fixed salary. Together, these steps mark a broader recalibration of the UK’s regulatory landscape, signaling a deliberate pivot toward market flexibility and financial sector growth. The government and regulators alike have been eager to reinforce London’s position as a premier global financial hub, particularly after the challenges posed by Brexit and increasing competition from international centers.

The impact of the Bank of England’s decision is expected to be felt across the City of London and beyond. For banks, the rule change could simplify pay structures and enhance retention by making bonus schemes more attractive. For employees, it means quicker access to deferred compensation and a more liquid reward structure. Yet for critics and policymakers, the move reignites an old debate: how to balance competitiveness with responsibility in a sector whose missteps once triggered global economic turmoil.

As the new rules take effect from October 16, 2025, financial firms are expected to adjust their remuneration policies immediately. Analysts anticipate renewed scrutiny from Parliament, investors, and the public as the first wave of restructured bonus payments rolls out. Whether the change revitalizes London’s financial ecosystem or risks loosening the hard-won safeguards of the post-crisis era remains to be seen.