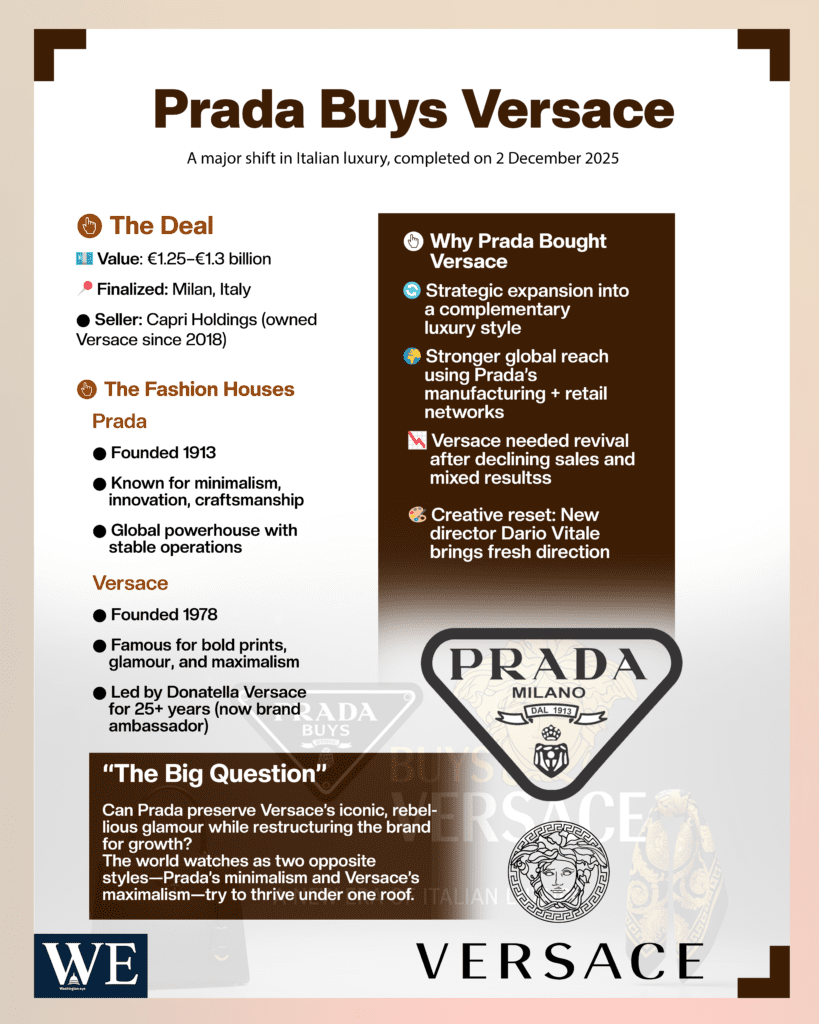

In a landmark moment for the global luxury industry, Prada has officially acquired Versace in a deal valued at approximately €1.25–1.3 billion, finalised on 2 December 2025 in Milan after receiving all regulatory approvals. The move marks one of the most significant consolidations in Italian fashion history, bringing together two of the most iconic and contrasting luxury houses under a single umbrella. The acquisition had first been announced in April 2025, when Prada agreed to buy Versace from Capri Holdings, the American parent company that had owned the brand since 2018. The completion of the transaction now gives Prada full control of Versace, signalling a strategic shift toward building a larger, more competitive Italian luxury group capable of standing alongside global giants like LVMH and Kering.

Prada, founded in 1913 by Mario Prada in Milan’s Galleria Vittorio Emanuele II, began as a leather-goods boutique before evolving into a global fashion house known for minimalist elegance, technical craftsmanship and the pioneering vision of Miuccia Prada. Over decades, Prada became synonymous with modernism and intellectual chic, shaping fashion in subtle yet revolutionary ways. Versace, by contrast, emerged in 1978 under the flamboyant genius of Gianni Versace, whose bold prints, Medusa emblem, glamorous silhouettes and celebrity-driven aesthetic defined an era of maximalist luxury.

The brand became a cultural force in the 1980s and 90s, celebrated for its unapologetic sensuality and theatrical runway shows. After Gianni’s tragic death in 1997, his sister Donatella Versace assumed creative leadership, shaping its distinctive identity for more than 25 years before stepping down in 2025. For many observers, the takeover by Prada marks a symbolic “return to Italian hands,” restoring Versace to domestic ownership after years under an American corporate group.

The reasons behind the acquisition reflect both opportunity and necessity. For Prada, the purchase represents a strategic expansion into a luxury segment that complements rather than competes with its own aesthetic. Prada’s leadership has emphasized that Versace’s global brand awareness, cultural impact and unique identity offer enormous potential if supported by stronger operational foundations.

Prada brings a deeply integrated manufacturing system, a vast retail network and decades of business stability, resources Versace has struggled to match in recent years. For Versace, the move offers a chance at revival after a period of declining sales, creative uncertainty and difficulty expanding its market share. Capri Holdings had attempted to revive Versace but faced mixed results, leading analysts to describe the sale as a “repositioning opportunity” for a brand that still carries immense cultural value.

Financially, the merger is considered bold. Versace’s profitability has been inconsistent, and its turnaround will likely require significant investment in both creative direction and global expansion. However, Prada believes the long-term potential outweighs short-term challenges. The new ownership structure also introduces fresh creative possibilities. Donatella Versace transitioned to a global brand ambassador role earlier in 2025, and designer Dario Vitale, previously associated with Prada’s sister brand Miu Miu, took over as creative director shortly before the sale. His appointment signalled an attempt to inject new energy while maintaining the brand’s DNA, though industry insiders speculate more artistic shifts may follow under Prada’s stewardship.

The impact of the deal extends far beyond boardrooms. The merger unites two distinct fashion philosophies, Prada’s refined minimalism and Versace’s theatrical maximalism, setting the stage for a diversified luxury powerhouse capable of serving multiple consumer identities. If managed successfully, Prada Group will gain a broader market reach and enhanced influence in both European and global retail landscapes.

For Italy, the acquisition strengthens the country’s position as a leader in high-end fashion manufacturing and heritage craftsmanship. Yet, the move also raises questions about whether Versace’s rebellious glamour will remain intact under a more structured corporate environment. Fashion critics argue that maintaining Versace’s provocative identity will be essential to preserving its global appeal. As the luxury industry watches closely, the coming seasons will reveal whether Prada can balance respect for Versace’s legacy with the discipline required to strengthen its performance.

For now, the merger represents a significant reshaping of Italian fashion’s power dynamics. With Prada at the helm, Versace enters a new chapter, one that blends its iconic past with a modern corporate vision. Whether this union becomes one of the most successful luxury revivals in recent history or a challenging balancing act will depend on how effectively the two aesthetic worlds can coexist under one roof.