Venezuela, long a geopolitical prize in Latin America for its vast oil reserves and strategic alliances, is now caught in a tightening squeeze between mounting U.S. pressure and China’s long-term investments, underscoring a new flashpoint in global power competition that may reshape energy markets, regional influence, and international diplomacy.

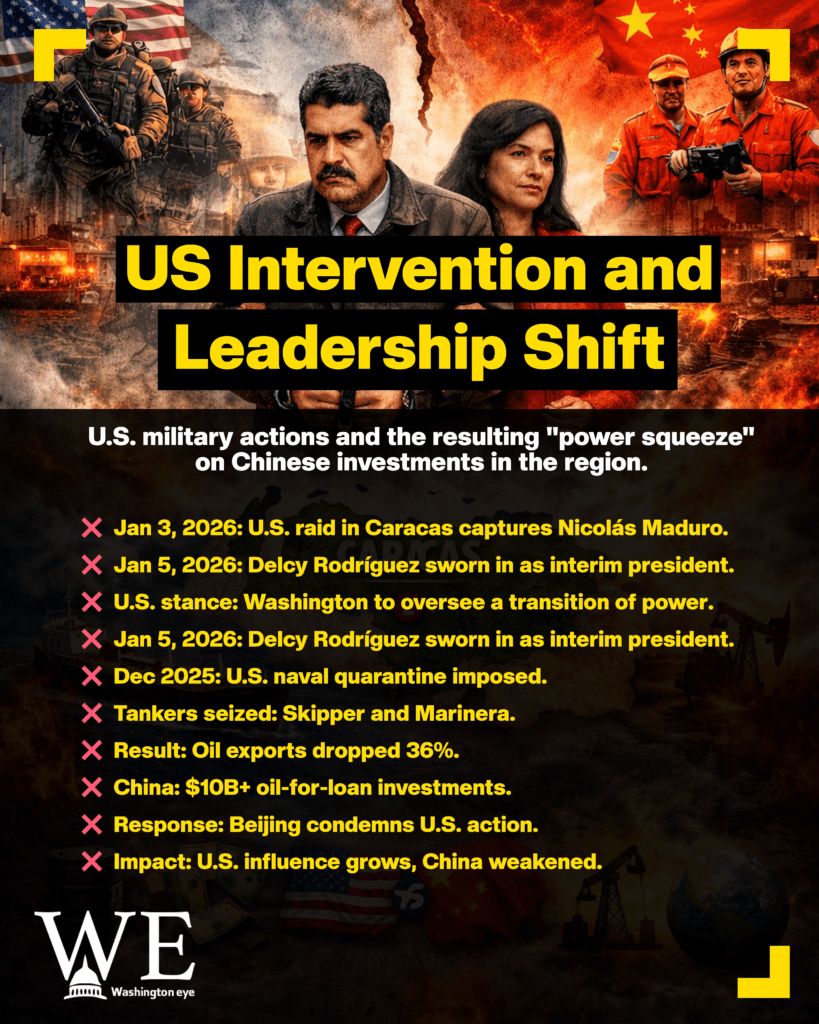

Since early January 2026, U.S. forces executed a dramatic operation in Caracas, arresting former president Nicolás Maduro and installing Delcy Rodríguez as interim leader, in what the Trump administration described as part of a broader campaign against narcotics trafficking and influence by “adversaries” in the Western Hemisphere. This intervention, coupled with naval seizures of sanctioned oil tankers in Caribbean waters as part of Operation Southern Spear, has effectively blockaded Venezuela’s oil exports, the lifeblood of its economy, and positioned the United States to control the flow of oil for the foreseeable future.

For years, Caracas had leaned on Beijing as a crucial partner. China’s state firms and policy banks have pumped billions of dollars into Venezuela’s energy sector under “oil-for-loan” arrangements totaling an estimated $10 billion+, granting Chinese companies rights to billions of barrels of Venezuelan crude and stakes in major projects. Before the latest crisis, Venezuelan exports to China, including shipments routed through independent “teapot” refineries, accounted for a notable share of Caracas’s crude sales, helping service debt and keep its battered economy afloat.

However, Washington’s sweeping assertion of control over Venezuela’s oil, including redirected cargoes and planned sales of 30–50 million barrels on the international market under U.S. oversight, has thrown those arrangements into disarray. President Trump has publicly declared that Venezuelan oil revenue will benefit Venezuelans while protecting U.S. interests, and that American companies will play central roles in rebuilding the country’s oil infrastructure.

Beijing has responded with formal protests, condemning U.S. actions as violations of sovereignty and demanding the release of Maduro, while simultaneously urging Chinese banks to disclose and reassess their exposure to Venezuelan credit risk. Chinese diplomats emphasize that maintaining broader U.S.–China economic stability, particularly amid fragile trade negotiations ahead of President Trump’s scheduled visit to Beijing, remains a priority, even as Venezuela becomes a contentious test case.

The stakes are high. Venezuela holds some of the world’s largest proven oil reserves, traditionally attracting both U.S. and Chinese energy interests eager to secure long-term supplies and strategic leverage. Yet years of mismanagement, entrenched sanctions, and collapsing production, now estimated at around 1.1 million barrels per day, down from 3.5 million bpd before the crisis, have weakened Caracas’s bargaining position.

China’s position is complicated. While Beijing is unlikely to relinquish its investments easily, analysts note that Venezuela represents only a modest share of China’s global energy imports, and that China is balancing its geopolitical posture against broader economic ties with the United States. Nevertheless, obstruction of oil flows and disruption of debt repayment channels could dent Chinese confidence in Latin America, already a region of rising geopolitical competition.

For Venezuela, the human cost is mounting. The economy teeters on collapse under the dual weight of the U.S. blockade and shrinking export revenues, with public services deteriorating and millions of citizens living in hardship after years of hyperinflation and mass emigration. As Washington asserts tactical control and Beijing pushes back diplomatically, Caracas finds itself squeezed between two superpowers with competing visions for the country’s future.

Experts warn this confrontation could redefine Latin America’s geopolitical landscape, weaken China’s influence in a region historically within the U.S. sphere, and set precedents for how global powers contest access to natural resources. While some U.S. policymakers view the push as a safeguard against adversarial influence, critics argue it risks deepening instability, undermining sovereignty, and provoking broader strategic friction with Beijing.

The economic cost, for Venezuela, China, and the global energy market, is substantial. Venezuela’s oil revenues have plummeted, China’s debt and investment returns are jeopardized, and the United States is committing political capital to its hegemony claims. Control over Venezuelan crude now sits largely with Washington, while Chinese firms reassess risk amid significant financial uncertainty.

As diplomatic negotiations and geopolitical chess continue, Venezuela’s fate will hinge on how hard both Beijing and Washington are willing to push, and whether Caracas can leverage its resources for a more balanced future in a world defined by great-power rivalry.