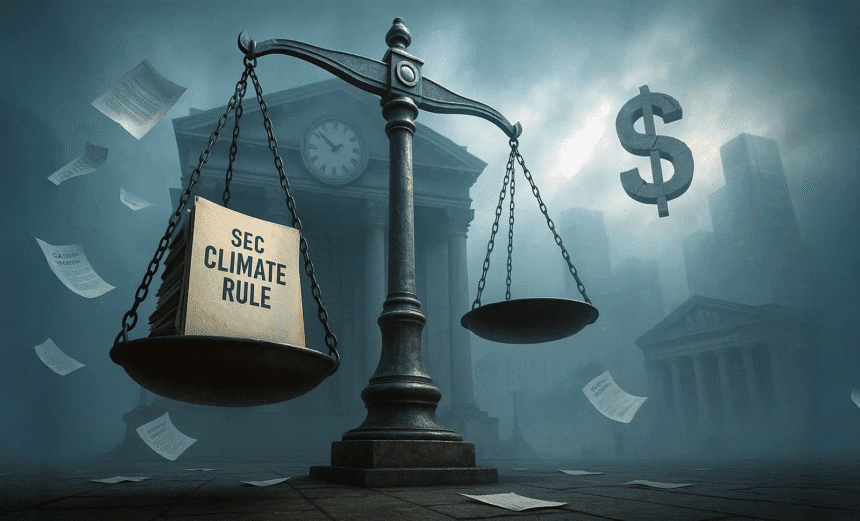

As the climate crisis accelerates and investor demand for environmental transparency grows louder, a sweeping U.S. Securities and Exchange Commission (SEC) rule meant to address those needs now sits in legal limbo. In a recent move that may reshape how financial regulators approach climate disclosure, the U.S. Court of Appeals for the Eighth Circuit has halted all litigation against the rule, at least for now, pending clarification from the SEC on whether it will continue to defend the regulation at all.

This judicial pause is more than a procedural footnote. It reflects a deeper uncertainty about the legal limits of climate regulation, the politicization of independent agencies, and the future of environmental accountability in American capital markets.

Not a Win or Loss, Yet

The court’s decision does not rule on the legality of the SEC’s climate disclosure rule. Instead, it suspends further legal proceedings until the SEC formally declares whether it intends to defend, amend, or rescind the rule altogether. Because implementation is already frozen, the court said there was no need to waste judicial resources on litigation that could soon be rendered moot or fundamentally changed.

This tactic of judicial abeyance signals a strategic delay, forcing the SEC’s hand and buying time for both the courts and businesses. But it also exposes how politically fragile major regulations can be, especially when executive power changes hands.

A Rule Caught in Crosswinds

Originally introduced in March 2024 under SEC Chair Gary Gensler, the rule would require publicly traded companies to disclose climate-related risks, greenhouse gas emissions, and financial impacts related to environmental issues. While framed as a way to protect investors from material climate risk, the regulation immediately drew fire from Republican-led states and fossil fuel interests, which argued it exceeded the SEC’s statutory authority and violated the so-called “major questions” doctrine, a legal theory the U.S. Supreme Court has increasingly embraced to limit agency powers.

After the SEC’s leadership shifted under the Trump administration in early 2025, the agency stopped defending the rule in court. That left challengers arguing against a rule whose authors were no longer defending it, prompting the court’s decision to press pause.

Uncertainty for Companies and Markets

For corporate compliance departments, this development brings temporary relief but long-term ambiguity. Preparing for the rule meant investing in emissions tracking systems, conducting climate risk analyses, and building disclosure frameworks that align with investor expectations and international standards. Now, many companies are unsure whether to continue those efforts or wait for definitive legal and regulatory outcomes.

The delay also reverberates in financial markets. Climate-related disclosures are widely viewed by institutional investors as essential for assessing exposure to long-term risks. In the absence of mandatory reporting, investors are left relying on inconsistent, voluntary disclosures that complicate accurate valuation of environmental liabilities. This regulatory vacuum may increase both legal and financial risk for firms with high carbon exposure, while reducing accountability overall.

Legal Stakes and Institutional Lessons

This case carries significant implications for administrative law. It will test how courts interpret the SEC’s statutory mandate, how far agencies can go in regulating climate-related information, and whether the judiciary continues to expand the major questions doctrine. But there are also lessons for how agencies craft durable rules. The SEC’s retreat under new leadership underscores the importance of building bipartisan legitimacy and clear statutory grounding if such regulations are to survive political cycles.

Moreover, the case highlights a growing concern: If independent agencies like the SEC can reverse course on major initiatives depending on electoral outcomes, the stability of long-term regulatory policy is threatened. Businesses and investors may hesitate to make strategic commitments based on rules that could be overturned every four years.

What Comes Next?

The SEC must now decide whether to stand behind the rule it once championed, revise it, or walk away entirely. Each option carries political, legal, and economic consequences. Until that decision is made, the climate rule remains in a state of suspended animation, neither fully alive nor legally dead.

This pause is not the end of the fight. It is a prelude to a larger legal and political confrontation over the future of climate disclosure in the U.S., and a test of how resilient climate governance can be in a divided regulatory landscape.