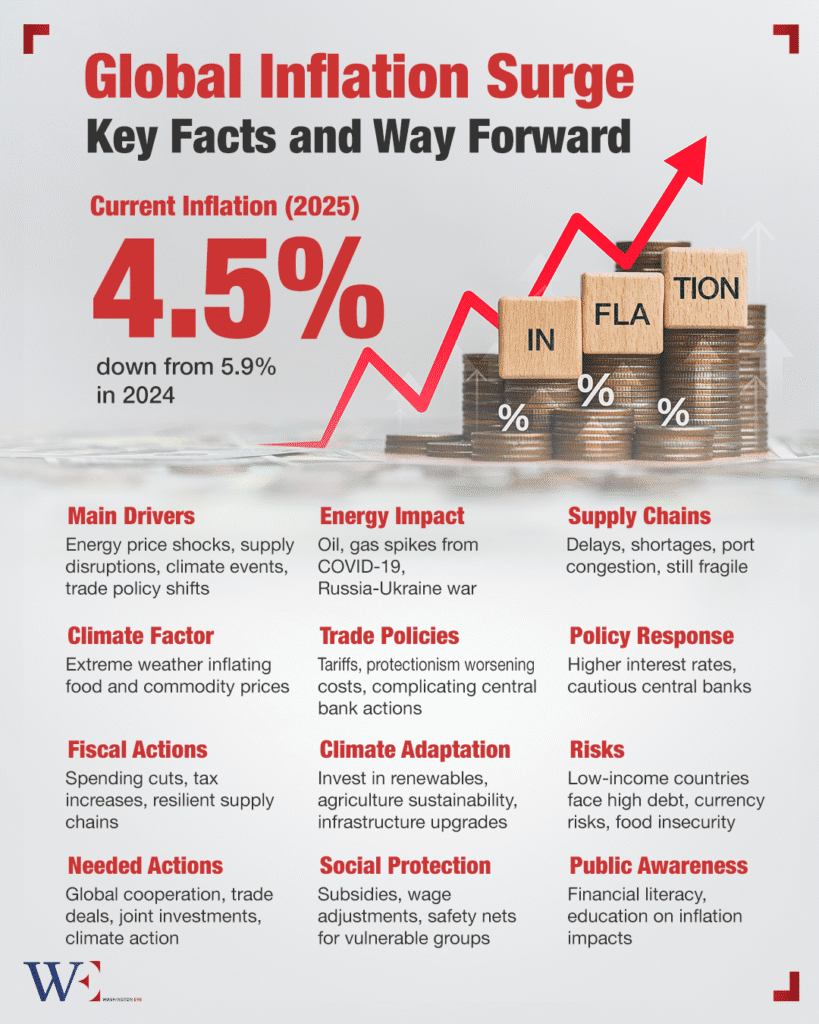

As of mid-2025, global inflation remains a significant concern for policymakers and citizens alike. Although the International Monetary Fund (IMF) projects a decline in global inflation from 5.9% in 2024 to 4.5% in 2025, these figures are still notably higher than pre-pandemic levels. The prolonged inflationary trends continue to affect consumer purchasing power, increase the cost of living, and challenge governments in maintaining economic stability.

Several key factors have driven the current wave of global inflation. One major cause is the series of energy price shocks experienced between 2021 and 2023. The COVID-19 pandemic disrupted global demand and supply dynamics, and the situation was worsened by geopolitical events such as the Russia-Ukraine war. These developments triggered a spike in oil, gas, and electricity prices, directly influencing production costs and indirectly affecting the prices of goods and services across sectors.

In addition to energy concerns, widespread supply chain disruptions have played a crucial role. During the pandemic, manufacturing delays, container shortages, and port congestion led to major logistical bottlenecks. These inefficiencies translated into increased costs, which were passed on to consumers in the form of higher prices. Although supply chains have started to recover, lingering vulnerabilities still make global trade susceptible to future shocks.

Another important contributor to inflation is climate change. Extreme weather events, such as floods, droughts, and wildfires, have severely impacted agricultural output and supply infrastructure. These disruptions have driven up food prices and introduced volatility into commodity markets. Climate-induced inflationary pressures are expected to persist unless long-term mitigation efforts are effectively implemented.

Policy shifts, especially in trade and tariffs, have also intensified inflation. New protectionist measures and increased tariffs—particularly between major economies—have made imports more expensive and disrupted global pricing structures. These shifts have complicated the efforts of central banks to manage inflation through traditional monetary policies.

In response to these challenges, a variety of policy measures are being pursued. Central banks in both developed and developing countries have increased interest rates in an attempt to slow down inflation. For example, the European Central Bank has lowered its key rates slightly but remains cautious, wary of persistent inflation caused by tariff-induced price increases. Higher interest rates reduce consumer spending and borrowing, thus helping to control inflation over time.

Governments are also turning to fiscal measures. By reducing public spending or increasing taxes, they aim to lower the money supply and reduce inflationary pressures. In parallel, there is a global push to make supply chains more resilient by diversifying sourcing strategies, investing in technology, and building stronger logistics networks. Furthermore, climate adaptation strategies are being prioritized. These include investing in renewable energy, enhancing agricultural sustainability, and preparing infrastructure for extreme weather. These measures not only help mitigate future inflation risks but also contribute to long-term economic resilience.

While inflation is projected to ease, it is clear that returning to pre-pandemic price stability will require coordinated global efforts. Addressing root causes—ranging from energy dependency to climate vulnerability—alongside prudent fiscal and monetary policies, will be key to ensuring sustainable economic recovery in the years ahead.

Although the worst of the inflation spike may have passed, economists warn that the global economy is not entirely out of the woods. Many low- and middle-income countries continue to face severe economic stress due to high debt levels and currency depreciation, which amplify the impact of imported inflation. In these regions, food and fuel prices remain dangerously volatile, pushing millions into poverty and food insecurity.

Policymakers are therefore urged to strike a delicate balance. On the one hand, tightening monetary policy is necessary to rein in inflation; on the other, doing so too aggressively can suppress economic growth and trigger recessions. International cooperation is more important than ever, as inflation is no longer a challenge that any one country can tackle alone. Cross-border solutions, such as coordinated trade agreements, joint infrastructure investments, and global climate action, are essential to creating a more stable economic environment.

Public awareness and social protection measures also play a vital role. As inflation disproportionately affects the poor, governments must ensure that targeted subsidies, wage adjustments, and safety nets are in place to shield vulnerable populations from the worst effects. At the same time, financial literacy campaigns can help citizens better understand inflation and manage their household finances more effectively.

The rise in global inflation is the result of a complex mix of interrelated factors—pandemic aftershocks, geopolitical conflicts, climate disruptions, and policy shifts. While inflation is beginning to slow, long-term stability will depend on how effectively the world can address these root causes. With coordinated global action, robust policy frameworks, and a renewed focus on sustainable growth, it is possible to bring inflation under control and build a more resilient economic future.