In his video address to the participants of the World Economic Forum in Davos on 23 January 2025, Donald J. Trump startled the audience when he asked OPEC and Saudi Arabia to slash global energy prices. With this statement, the new president not only elevated energy sovereignty as a key policy priority, but he also left some to worry about the unintended consequences of such a move.

Positions, Interests and Reality

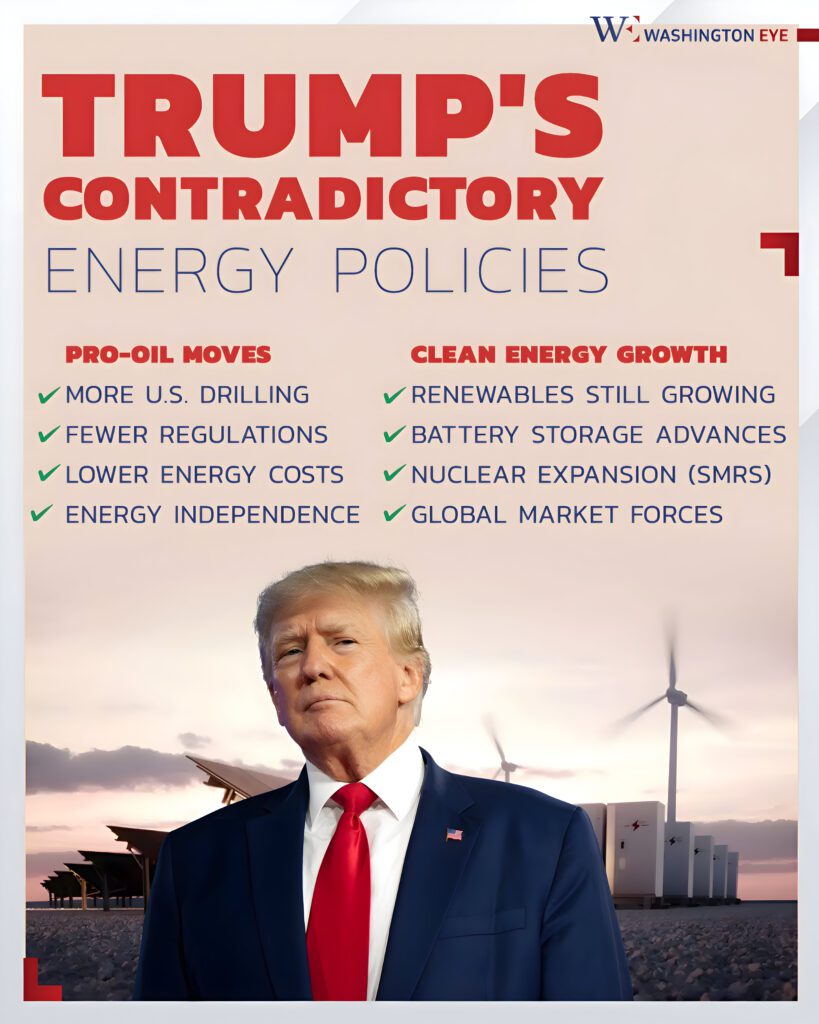

A proper assessment of the Trump presidency’s impact on global energy, however, needs to consider the matter not only through the lens of Trump’s policy position but also through that of US national interests, as well as the reality of global energy markets. Trump often uses contradictory positions as bargaining tactics. It is important to recognize, however, that Trump is, first and foremost, a dealmaker and as such not interested in fixed positions.

Nevertheless, his campaign pledge to lower oil prices could have adverse consequences for global energy markets, mainly due to three reasons: first, he has threatened to impose hefty tariffs on goods from several economies, including Canada and Mexico, and has done so in the case of China already, which may spark a trade war and lead to inflationary consequences in the US. Second, he aims to unleash drilling and accelerate the licensing of oil and gas projects, which depends on high oil prices to attract investment and sustain the US shale industry. Finally, he plans to increase sanctions on Iran and curtail its oil exports, which could take between half a million to 1 million barrels of oil per day off the market.

But while Trump favours fossil fuels, the reality of global oil markets will continue to drive clean energy. These contradictory positions suggest that, against common assumptions, oil prices may not drop significantly. Rather, Trump’s approach to oil markets may depend on the deals he makes with global partners, including with OPEC+, which could shape oil production, exports and prices.

In terms of the reality of the market, clean energy deployment is shaped by market dynamics and business interests rather than US federal policy. As a consequence, Trump’s energy policies are unlikely to harm clean energy growth in any significant way. Renewable energy-plus-battery storage, for instance, is increasingly cost-competitive, as businesses and investors prioritize these solutions out of an economic logic rather than by policy mandates. Nuclear energy also stands to benefit, with growing interest in small modular reactors (SMRs) and political commitment to expand nuclear as a low-carbon power source. Many corporations and utilities are committed to long-term clean energy goals, while state-level policies and global demand for low-carbon technologies provide additional momentum.

Impact on Clean Energy Growth in the Middle East

One of the Middle East’s key characteristics is that regional economies’ core interests in clean energy deployment lie in energy security and economic priorities. Meanwhile, the oil price continues to be the overall factor shaping the pace of the transformation.

Oil producers rely on their revenues to grow the non-oil economy and invest in clean energy, so oil revenue is critical for economic and energy diversification in the Middle East. Meanwhile, oil importers rely on producers for remittances. If oil prices fall, some clean energy projects, including renewables, hydrogen, and carbon capture projects, are likely to be paused.

However, expectations that the Trump administration would slow clean energy deployment in the Middle East are unfounded. This is because the primary driver of energy diversification in the region is reducing domestic fossil fuel reliance – a goal that remains unchanged regardless of US administrations or climate policies.

All countries in the Middle East are interested in reducing their domestic fossil fuel use, whether they are net exporters or importers. Net exporters aim to free oil and gas for exports, while net importers struggle with hefty fuel import bills. However, clean energy projects in MENA still rely on government funding, which is tied to oil revenues.

Republished with Permission by the Middle East Institute Switzerland