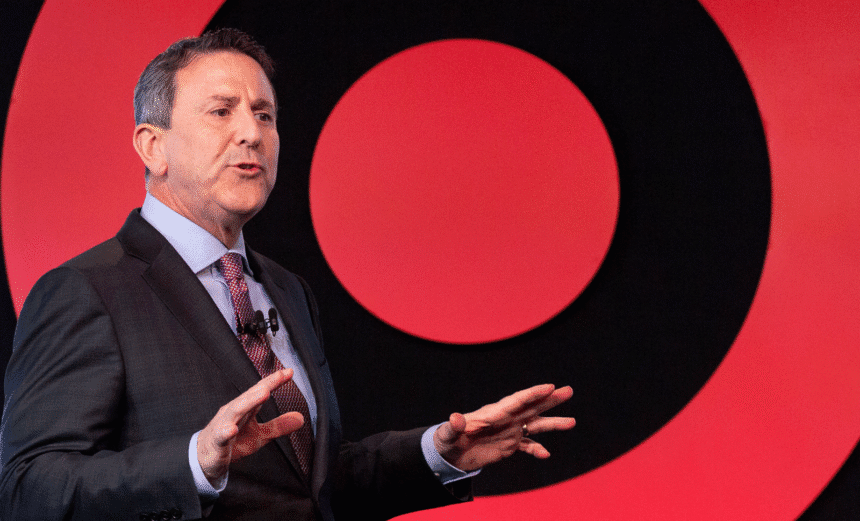

Target Corporation announced that longtime CEO Brian Cornell will step down on February 1, 2026, after an 11-year tenure that transformed but ultimately challenged the retailer. The decision comes during one of the toughest periods for the company in recent memory, as it struggles with slumping sales, customer backlash, and a controversial retreat from diversity, equity, and inclusion (DEI) initiatives. Cornell will be succeeded by Michael Fiddelke, the company’s chief operating officer and a 20-year veteran of Target.

Cornell, who took the helm in 2014, was widely credited with reinvigorating the brand by emphasizing trendy private-label products and modernizing its stores. For several years, Target was seen as a bright spot in retail, appealing to customers with affordable yet stylish offerings. But the post-pandemic years have been turbulent. The company has reported nine out of eleven quarters of flat or declining comparable sales, with net income down 21% in the latest quarter ending August 2. Investors reacted sharply to Cornell’s departure announcement, with Target’s shares falling between 6–8% on Wall Street amid doubts that an insider successor can deliver the bold changes required.

Adding to financial woes is a cultural battle. In early 2025, Target scaled back its DEI programs, once seen as a hallmark of its corporate identity, sparking a consumer boycott and criticism from advocacy groups. The retreat came after prior controversies around Pride merchandise and DEI commitments, which had already placed the retailer at the center of heated cultural debates. While some shareholders applauded the rollback, critics argued that Target’s reputation as an inclusive brand was severely damaged, alienating loyal shoppers and communities.

Incoming CEO Michael Fiddelke has laid out a three-pronged turnaround plan. First, Target will double down on its exclusive private-label brands while strengthening partnerships with major national names to diversify its offerings, particularly in apparel and home goods. Second, it will reimagine the in-store shopping experience, aiming to bring back the enjoyable and “Tarzhay” vibe that once differentiated it from Walmart and Amazon. Third, the company will modernize operations through new technologies and eliminate inefficiencies in its legacy systems, making stores and logistics leaner and faster. Fiddelke’s challenge will be to deliver meaningful results quickly, as Target’s competitors, including Walmart, Costco, and Amazon, continue to capture market share.

Still, the road ahead is steep. Target’s sales slump has created serious financial pressure, while the backlash over its DEI policies has eroded customer trust. Analysts warn that Fiddelke must not only address the numbers but also rebuild Target’s image in a divided consumer landscape. Some investors remain skeptical that an internal hire can bring the necessary fresh perspective, though others argue that his deep knowledge of Target’s culture and operations gives him a unique advantage.

Ultimately, the leadership change marks a turning point for Target. Brian Cornell, who helped the company recover from a rocky period in the early 2010s, now leaves behind a mixed legacy, one of bold growth but also of declining momentum and cultural controversy. Whether Michael Fiddelke can restore Target’s financial performance and public trust will be the central test of his leadership. For shoppers and shareholders alike, the next year will determine if Target can regain its reputation for affordability, inclusivity, and the signature “Tarzhay swagger” that once made it a retail favorite.