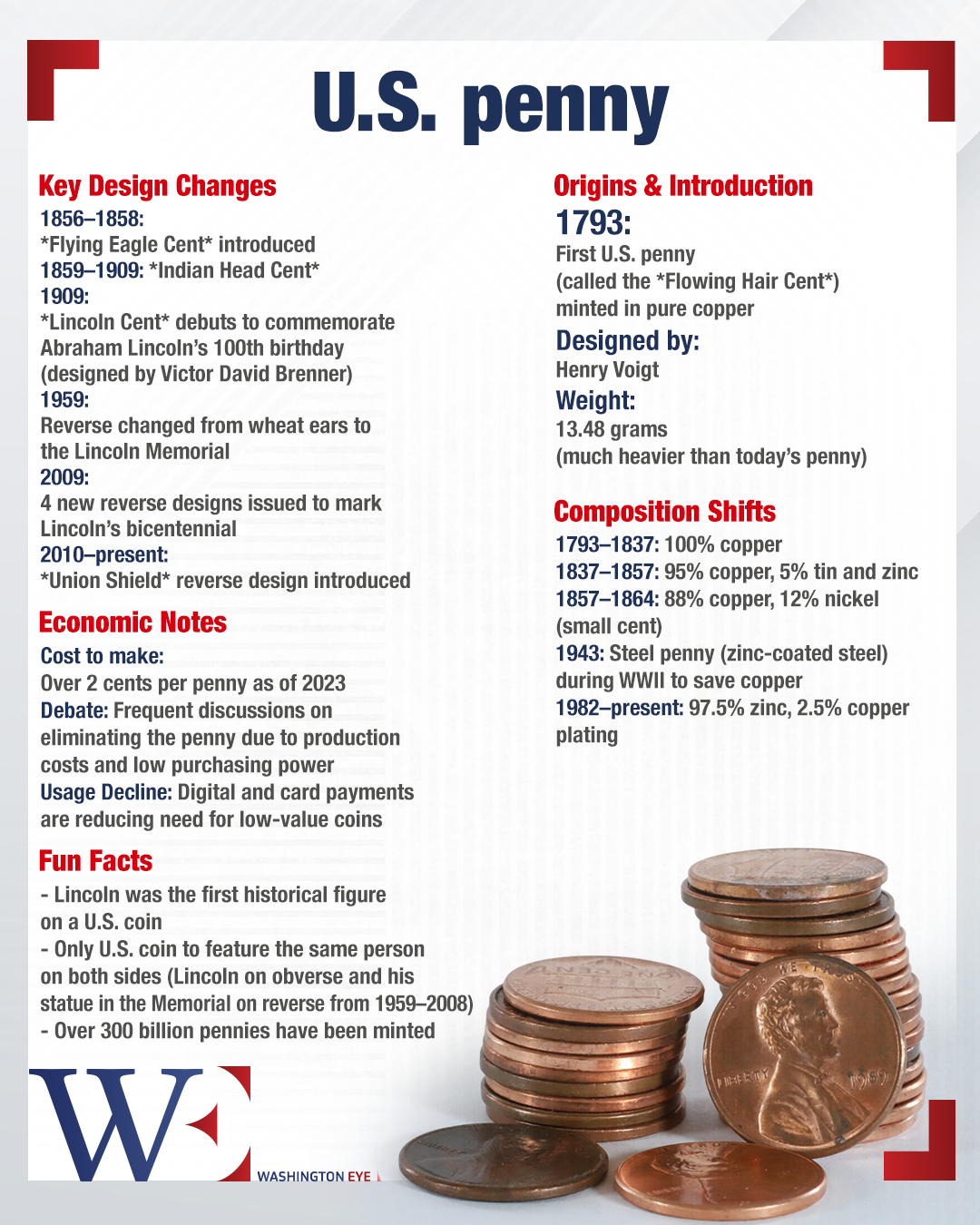

In a significant shift in U.S. currency policy, the U.S. Treasury Department has announced plans to halt the production and circulation of the penny by early 2026. This decision ends over two centuries of minting the nation’s lowest-denomination coin, first introduced in 1793. The move is primarily driven by the rising costs of production and the diminishing utility of the penny in everyday transactions.

The primary factor influencing the discontinuation is the cost of producing the penny. According to the U.S. Mint, each penny costs nearly 3.7 cents to produce, factoring in materials, labor, and distribution. In the 2024 fiscal year alone, the Mint reported a loss of $85.3 million from producing approximately 3.2 billion pennies. This financial imbalance has prompted calls for reevaluation of the coin’s viability.

Beyond production costs, the penny’s practical use has significantly declined. Modern vending machines, toll booths, and parking meters often do not accept pennies. Moreover, many consumers tend to store pennies rather than spend them, leading to a circulation inefficiency. Estimates suggest that a substantial portion of the 114 billion pennies in circulation are not actively used in transactions.

The cessation of penny production is scheduled to be completed by early 2026. The U.S. Mint has already placed its final order for penny blanks, signaling the commencement of the phase-out process. Once production halts, existing pennies will remain legal tender and continue to circulate until they are naturally withdrawn from use.

With the elimination of the penny, cash transactions will be rounded to the nearest five cents. This practice aligns with methods adopted by other countries, such as Canada, which ceased penny production in 2013. In Canada’s case, studies have shown minimal financial impact on consumers due to rounding.

Digital transactions, including credit and debit card payments, will not be affected and will continue to be processed to the exact cent. Retailers are expected to adjust their pricing strategies accordingly, and guidelines will be provided to ensure consistency in rounding practices.

The decision to discontinue the penny has garnered bipartisan support. Legislation such as the “Make Sense Not Cents Act” and the “Common Cents Act” have been introduced in Congress to formalize the cessation. Additionally, former President Donald Trump publicly endorsed the move, citing the wastefulness of producing a coin that costs more than its face value. He emphasized the need to eliminate unnecessary expenditures in the federal budget.

While the financial rationale for eliminating the penny is compelling, some concerns have been raised. One issue is the potential increased reliance on nickels, which are more expensive to produce—each nickel costs approximately 13.8 cents to manufacture. If the demand for nickels rises significantly, the anticipated savings from discontinuing the penny could be offset.

Additionally, some consumer advocacy groups worry about the possibility of retailers consistently rounding prices up, leading to a subtle inflationary effect. However, studies from countries that have eliminated their smallest denomination coins suggest that such impacts are negligible.

The penny has been a staple of U.S. currency since the 18th century, with President Abraham Lincoln’s likeness adorning the coin since 1909. Despite its historical significance, public sentiment has shifted. A national survey conducted in January 2017 found that 77% of voters supported suspending penny production, with support increasing to 84% when informed of the potential savings.

The move to eliminate the penny reflects broader trends in currency usage, with a growing preference for digital transactions and a decline in the use of physical coins. As the U.S. adapts to these changes, the discontinuation of the penny represents a step toward a more efficient and cost-effective monetary system.