The global trade landscape has undergone a tectonic shift since the implementation of aggressive new trade policies a year ago. What began as a series of targeted executive actions in early 2025 has evolved into a comprehensive economic experiment that has tested the resilience of domestic markets and the flexibility of international supply chains. By February 2026, the initial shock of these measures has transitioned into a complex reality where increased federal revenue and localized industrial protectionism are balanced against rising consumer costs and a persistent trade deficit. The following analysis examines the multifaceted impact of these policies one year into their enforcement.

Escalating Costs and Consumer Purchasing Power

The most immediate and visible consequence of the trade measures has been the upward pressure on domestic prices. According to recent data from The Budget Lab at Yale, the average effective tariff rate in the United States surged from roughly 2.4 percent at the start of 2025 to nearly 17 percent by early 2026. This dramatic escalation has funneled through the supply chain, particularly impacting sectors reliant on imported components. While some corporations initially absorbed these costs by utilizing pre existing inventories, those stockpiles have largely been exhausted.

The resulting inflationary pressure has been significant. Projections from the Penn Wharton Budget Model suggest that middle income households face substantial lifetime losses in purchasing power due to these price hikes, with some estimates citing a 22,000 dollar loss per household over the long term. In the short term, the Bureau of Economic Analysis has noted that personal consumption expenditure inflation remains a primary concern for the Federal Reserve, as core goods prices have risen faster than the historical trend. This suggests that while the tariffs have successfully generated revenue, the burden has largely been shifted to the American consumer.

Industrial Shifts and the Trade Deficit Paradox

One of the central goals of the 2025 trade policy was to revitalize domestic manufacturing and reduce the national trade deficit. However, the results after twelve months present a nuanced picture. While certain industries like steel and aluminum have seen a modest uptick in domestic production capacity, the broader manufacturing sector has struggled with the increased cost of raw materials. The Tax Foundation reports that these trade barriers act as a tax on production, which can ironically hinder the very industrial growth the policies sought to foster.

Furthermore, the trade deficit has not followed the downward trajectory many proponents expected. Data from the Census Bureau for late 2025 and early 2026 indicates that the goods and services deficit remains substantial, occasionally spiking due to fluctuations in global demand and the increased cost of imported capital goods. The persistent deficit with major partners like China and Mexico highlights the difficulty of decoupling from deeply integrated global supply networks, even in a high tariff environment.

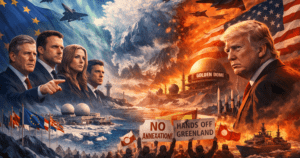

Retaliation and Global Diplomatic Friction

The international response to the American trade experiment has been characterized by strategic retaliation and a shift in global alliances. Major trading blocks, including the European Union and China, have implemented their own sets of reciprocal tariffs, targeting American agricultural exports like chicken, corn, and soybeans. This back and forth has created a climate of trade policy uncertainty that the ifo Institute suggests is slowing global investment.

In addition to direct tariffs, many nations have sought to diversify their trade relationships away from the United States, accelerating the formation of regional trade agreements that exclude American interests. This diplomatic friction has complicated international cooperation on other economic fronts. As the world adjusts to a more fragmented trade system, the long term challenge for American policymakers will be maintaining global competitiveness while operating within a more isolated economic framework.

A Final Note

The trade experiment of 2025 has succeeded in altering the status quo and generating trillions in potential federal revenue, yet it has also introduced structural risks to the domestic economy. As we move further into 2026, the sustainability of this model will depend on whether the revenue gains can be effectively used to offset the rising cost of living for the average citizen.