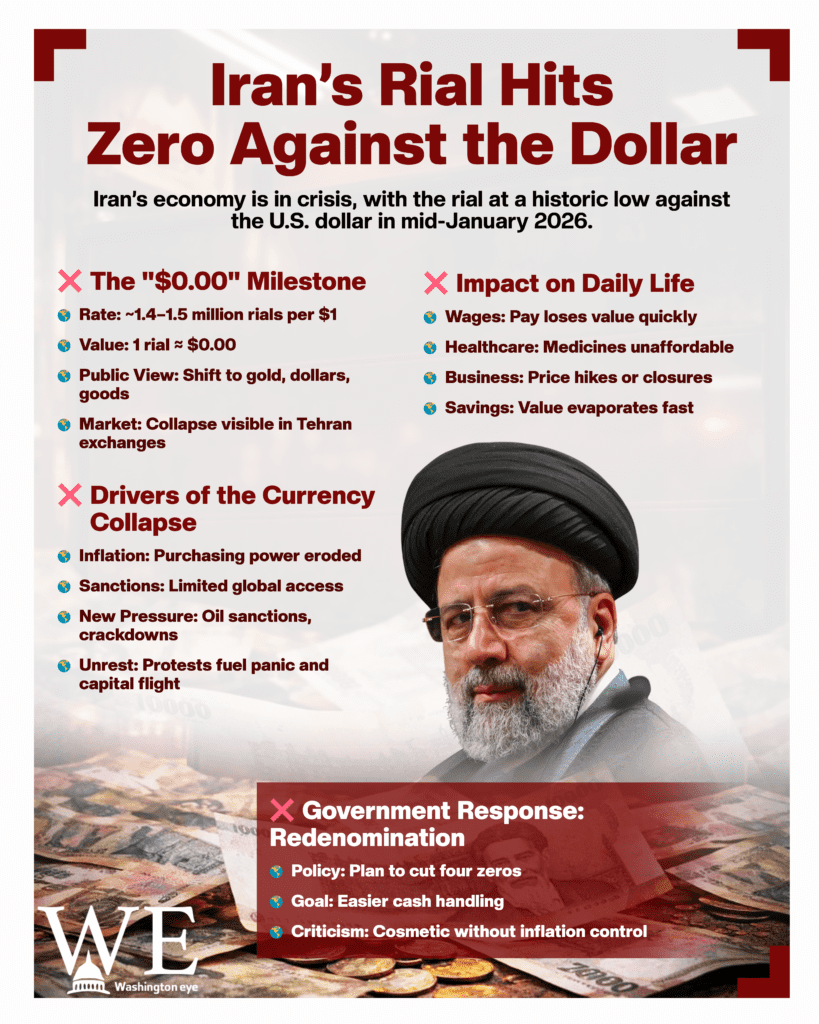

Iran’s national currency has sunk so low that a single rial now registers as $0.00 when converted into U.S. dollars at normal retail precision, an eye-catching shorthand for a deeper economic breakdown that has been years in the making. In mid-January 2026, open-market trackers put the rate at roughly 1.4–1.5 million rials for $1, meaning 1 rial equals only a microscopic fraction of a cent, effectively “zero” for most everyday comparisons and cross-border transactions.

The collapse is most visible in Iran’s cash economy: Tehran’s exchange shops, informal traders, and online rate boards where people check the dollar price before they set the price of imported goods, rent, medical supplies, and even some locally produced items whose inputs are tied to foreign currency. Economists say the symbolism of “$0.00” matters because it captures a public reality: for many Iranians, the rial no longer works as a stable store of value, pushing households to scramble for hard currency, gold, or durable goods whenever they can.

Multiple shocks have converged. Chronic inflation has eaten purchasing power, while sanctions pressure, restricted access to the global financial system, and uncertainty around oil revenue have constrained the country’s ability to stabilize the currency. Recent reporting also points to renewed political and security tensions feeding market panic, with protests and a harsh crackdown adding to economic anxiety and capital flight.

For ordinary Iranians, the impact is brutally practical. Salaries lose value between payday and the next grocery run. Imported medicines and specialized treatments become harder to afford. Small businesses that rely on foreign components face volatile costs, forcing them to raise prices, reduce quality, or shut down. Families planning weddings, tuition payments, or housing deposits find their savings evaporating unless they can convert into something that holds value. Those with relatives abroad increasingly depend on remittances, while those without such support feel trapped inside an economy whose currency can’t reliably buy what it did a month ago.

The currency’s plunge is also reshaping social and political life. Demonstrations in recent weeks have been linked to rising prices and a falling rial, with analysts describing a feedback loop: a weaker currency pushes prices up, higher prices fuel anger, unrest raises uncertainty, and uncertainty further weakens the currency. The government has blamed external pressure and illicit financial networks, while critics point to mismanagement, corruption, and a lack of credible reform.

Internationally, the “zero-value rial” narrative lands at a tense moment. Washington has announced new sanctions tied to Iran’s internal crackdown and alleged financial networks connected to oil revenues, moves that can further chill investor confidence and complicate any near-term stabilization effort. Regional traders watching Iran’s market say currency instability can spill into cross-border commerce, from payment frictions to higher risk premiums on Iranian counterparties.

Tehran’s policymakers have floated technical fixes, but none is a quick cure. One high-profile step is redenomination, removing zeros from banknotes to simplify accounting and cash transactions. Iran’s parliament has approved plans to cut four zeros, effectively resetting the scale of prices without changing underlying purchasing power. Supporters argue it can reduce cash-handling chaos; skeptics warn it’s cosmetic unless inflation is tamed and confidence returns.

What happens next depends less on the number printed on banknotes and more on credibility: whether authorities can curb inflation, reduce uncertainty, and restore access to sustainable foreign-currency inflows. Until then, Iranians are likely to keep treating the exchange rate like a daily weather report, because in today’s Iran, the rial may still be legal tender, but in global terms it has become so small that it looks like nothing at all.