by: The Washington Eye

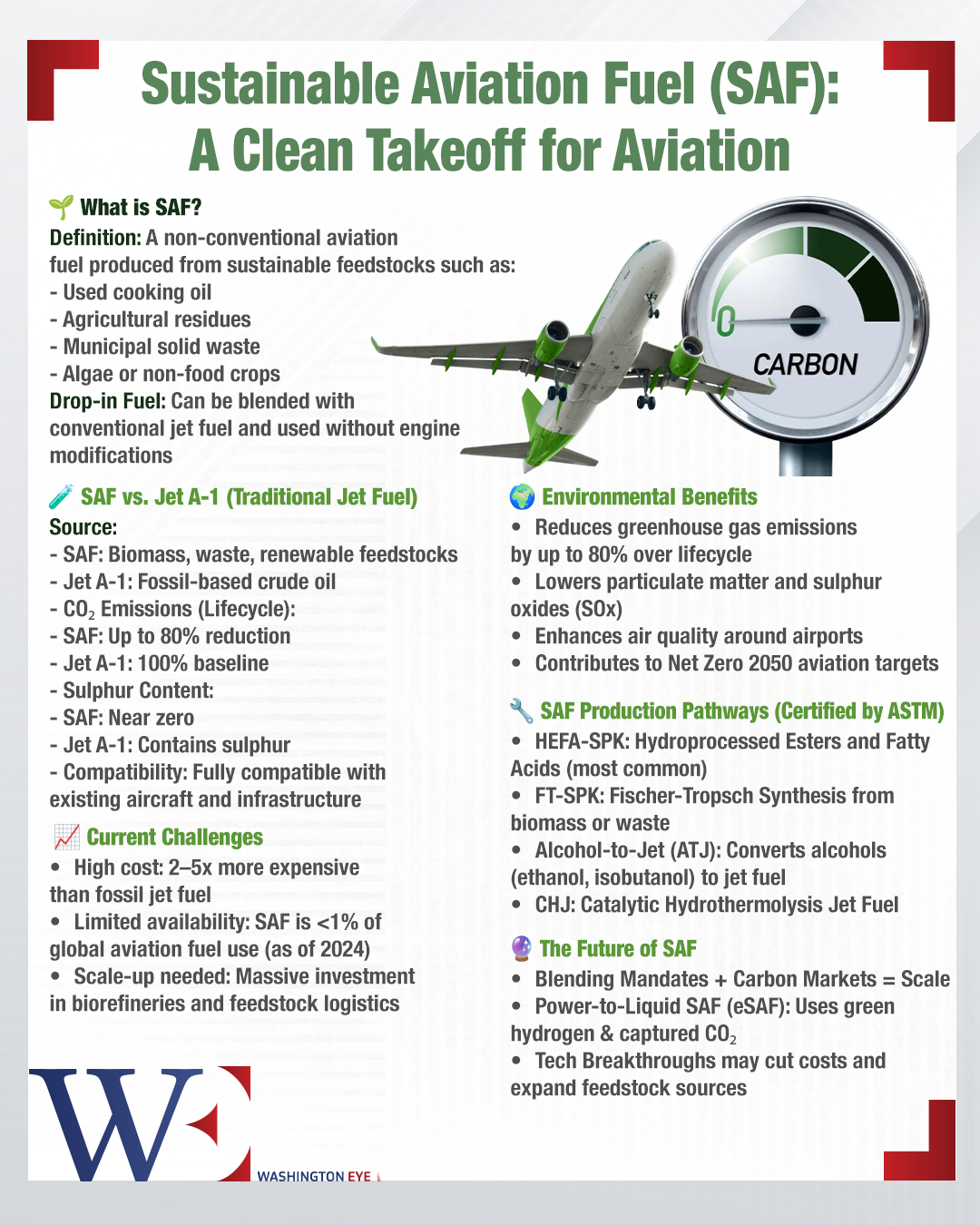

As the aviation sector hurtles toward its 2050 net-zero carbon target, sustainable aviation fuel (SAF) has emerged as the linchpin of decarbonization efforts. In 2025, global SAF production is projected to double to 2 million tonnes, a major step forward. However, even at this increased capacity, SAF will constitute a mere 0.7% of total airline fuel consumption—an indicator of both progress and the monumental gap that remains.

Scale and Symbolism: The Doubling Effect

The expected doubling of SAF production reflects a surge in investments, policy incentives, and public-private partnerships aimed at accelerating green aviation. While encouraging, this growth must be contextualized. Commercial airlines consume over 300 million tonnes of jet fuel annually. At 2 million tonnes, SAF remains symbolic rather than transformative, suggesting that the sector’s energy transition is still in its infancy.

According to the International Air Transport Association (IATA), this symbolic growth nonetheless sets an important precedent. SAF is one of the only immediately available solutions that can be used in existing aircraft and fueling infrastructure, making it critical for short-to-medium term emissions reductions.

The Cost Barrier: A Premium on Sustainability

Despite this momentum, the economics of SAF remain daunting. IATA has reported that the average cost of SAF is currently 4.2 times higher than conventional jet fuel. This premium is largely attributed to regulatory compliance fees imposed on European fuel suppliers, as well as the still-nascent state of SAF production infrastructure.

This price disparity introduces a tension between environmental goals and operational viability. Airlines, already facing thin profit margins, are unlikely to absorb these costs without significant external incentives or regulatory frameworks. In the absence of coordinated global policy and subsidization, many carriers may opt for marginal SAF use as a symbolic gesture rather than a scalable solution.

A Transatlantic Divide: The U.S. and the SAF Market

While Europe leads in regulatory pressure and early-stage deployment, the United States is fast becoming the SAF production frontier. Backed by the Inflation Reduction Act and the Sustainable Aviation Fuel Grand Challenge—a joint initiative by the DOE, USDA, and DOT—the U.S. aims to produce 3 billion gallons of SAF annually by 2030. This target vastly exceeds current output and, if met, would represent a game-changing share of global supply.

Unlike Europe’s tax-heavy approach, the U.S. is offering direct production incentives and tax credits to lower the cost curve. The 2022 IRA, for instance, includes a SAF-specific tax credit of up to $1.75 per gallon, depending on carbon intensity. This has made the U.S. an increasingly attractive market for SAF developers and investors, and sets up a divergence in how the transatlantic regions approach decarbonization: regulation vs. subsidization.

However, even with U.S. incentives, scalability challenges remain. Feedstock availability, refinery conversion timelines, and the need for consistent offtake agreements are hurdles that must be overcome. But the American strategy offers a valuable experiment in market-driven acceleration that, if successful, could complement Europe’s regulatory push.

Policy, Technology, and Market Maturity

The SAF dilemma underscores a larger truth about the green transition in aviation: innovation alone is not enough. While advances in feedstock processing, waste-to-fuel technologies, and carbon lifecycle management are underway, the bottleneck remains the commercialization and affordability of these solutions.

Europe’s regulatory architecture, which includes compliance costs under mechanisms like the Emissions Trading System (ETS), has created a paradox. It penalizes carbon-intensive fuels but inadvertently raises the cost of sustainable alternatives, thereby slowing adoption. Without transcontinental policy coordination—especially involving major aviation markets like the U.S., China, and the Middle East—these asymmetries could become long-term barriers to decarbonization.

The Path Forward: Strategic Compromise

Meeting the 2050 net-zero goal will require more than SAF; it demands an integrated strategy that includes electric aircraft for regional routes, hydrogen propulsion technologies, and a fundamental redesign of air traffic management systems. Still, SAF holds a unique role in bridging the gap until these longer-term innovations mature.

To unlock SAF’s potential, stakeholders must push for stronger global mandates, greater investment in second-generation feedstocks, and price stabilization mechanisms such as contracts for difference (CfDs). The path ahead is not only technological but also deeply political and economic.

While SAF production is poised to double, its impact will be determined by whether that growth is coupled with structural reforms. Without them, sustainable aviation risks remaining a premium product for a niche market—rather than a cornerstone of the industry’s future.