Tesla’s early days in Europe were marked by fanfare, innovation, and unmatched ambition. The Gigafactory Berlin, hailed as a “machine that builds the machine,” was meant to be the crowning jewel of Elon Musk’s expansion into the continent. Fast forward to 2025, and that same jewel is beginning to rust. Tesla’s European decline is no longer a market anomaly – it’s a steady fall from grace.

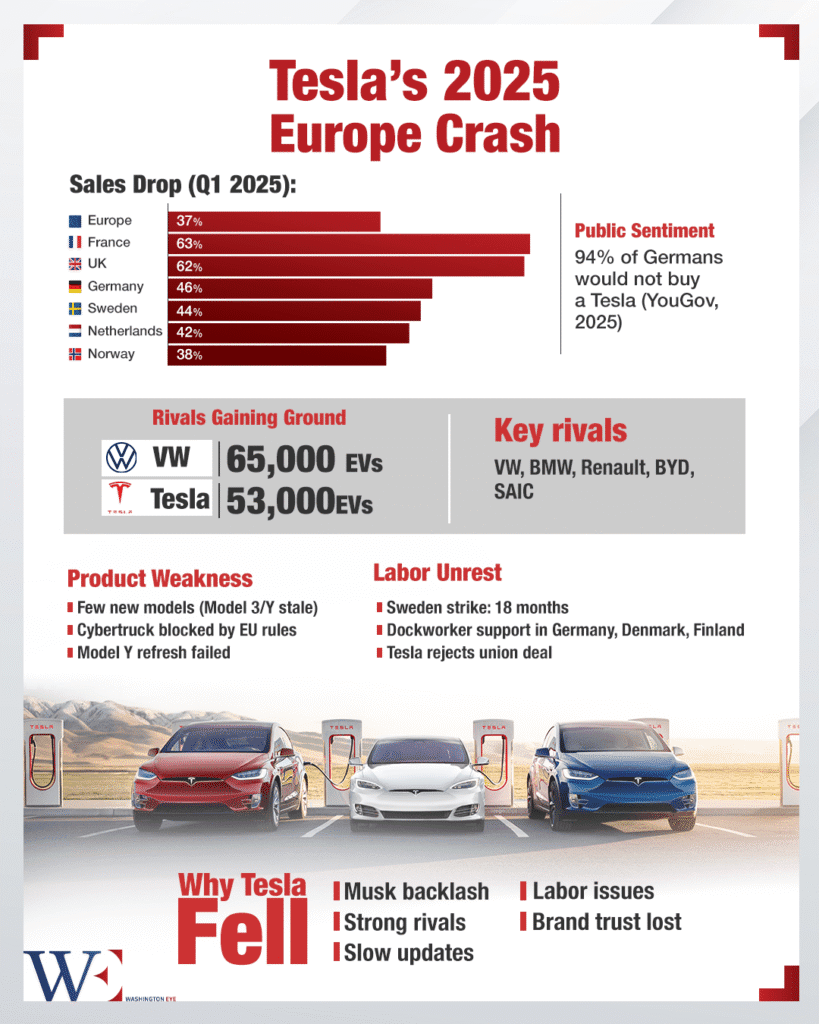

According to the latest industry data, Tesla’s Q1 2025 sales in Europe dropped by a staggering 37%. In markets like France and the UK, the decline was even steeper – 63% and 62% respectively. Germany, where Tesla once reigned supreme, witnessed a 46% fall in sales, despite the nation’s strong EV infrastructure and consumer interest. These numbers are not blips; they are loud signals of consumer dissatisfaction and strategic missteps. So, what happened? How did the darling of the electric revolution lose traction on one of the world’s most environmentally progressive continents?

Elon Musk: Innovator or Liability?

Public perception matters, and in Europe – where cultural memory and political sensitivities are deeply embedded – Musk’s increasingly erratic behavior has become toxic. His endorsements of Germany’s far-right AfD party and dismissive comments on the country’s historical trauma were met with outrage. Germany’s Federal Minister for Economic Affairs, Robert Habeck, called Musk’s behavior “irresponsible and dangerous.”

A 2025 YouGov survey confirmed the damage: 94% of Germans stated they would not consider buying a Tesla. In a region where consumers often “vote” with their euros, especially on matters of principle, Musk’s provocations are driving them straight into the arms of competitors.

The Rise of Rivals

Tesla is no longer the only game in town. European automakers like Volkswagen, BMW, and Renault have swiftly electrified their lineups and offered what European consumers crave – reliable, stylish, and sustainable vehicles that also support local economies.

Volkswagen, for instance, outsold Tesla in Q1 2025 with over 65,000 EVs compared to Tesla’s 53,000. Chinese brands like BYD and SAIC are also sweeping through Europe with competitively priced, high-tech models. When innovation is no longer Tesla-exclusive, consumers begin to weigh other factors: price, after-sales service, ethical sourcing, and yes – political values.

Product Stagnation in a Fast-Moving Market

While competitors are rolling out newer, feature-packed models at breakneck speed, Tesla’s European offering remains limited to the increasingly stale Model 3 and Model Y. The promised refresh of the Model Y, launched in January 2025, was expected to revive interest. It didn’t. Sales have remained flat, and even generous financing options failed to reverse the slump.

Tesla’s Cybertruck, a symbol of Musk’s ambition, remains absent from European roads – both due to regulatory hurdles and questionable design appeal in a region that values compact efficiency over American bravado.

Labor Strikes and Operational Headaches

Tesla’s aversion to unionization is not playing well in Europe. In Sweden, a country that prides itself on labor rights, Tesla’s refusal to sign a collective bargaining agreement led to a widespread strike that is now in its 18th month. Dockworkers in Germany, Denmark, and Finland joined in solidarity, refusing to unload Tesla shipments. This multi-nation labor conflict is the most significant industrial action Tesla has faced in its history – and it’s unfolding in one of its most critical markets.

5. The Numbers Don’t Lie

Here’s a breakdown of Tesla’s sales drop across major European markets:

| Country | Sales Decline (%) |

| France | 63 % |

| UK | 62 % |

| Germany | 46 % |

| Sweden | 44% |

| Netherlands | 42 % |

| Norway | 38% |

Can Tesla Recover?

Possibly – but only with a hard reset. That means distancing the brand from Elon Musk’s personal politics, accelerating product innovation, and embracing European labor norms. It also means rebuilding trust with a customer base that once admired Tesla for leading the EV revolution, not for provoking culture wars on social media.

Tesla’s fall in Europe is more than a corporate story. It’s a case study in what happens when visionaries believe they are invincible. Innovation must be matched by humility, and success by responsibility. If Tesla wants to regain its crown in Europe, it will need more than over-the-air updates and flashy launches. It will need to win back hearts – one responsible decision at a time.