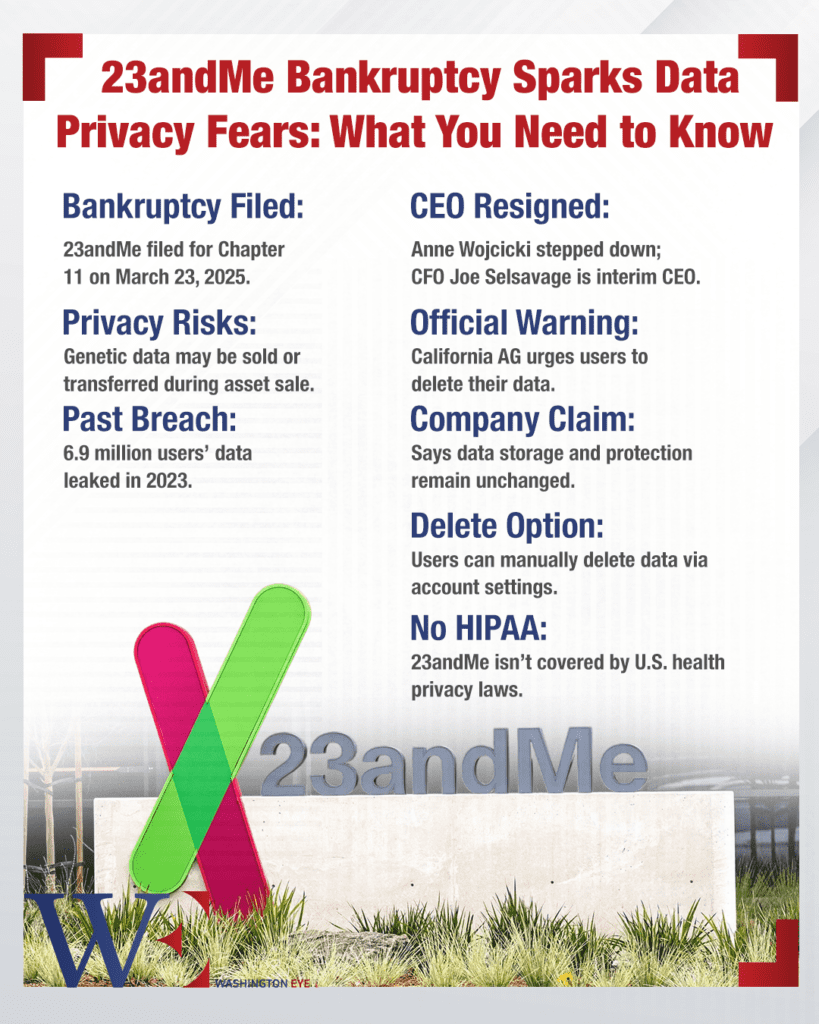

In a significant development within the biotechnology sector, 23andMe, the renowned genetic testing company, has filed for Chapter 11 bankruptcy protection in the United States. This move aims to facilitate a court-supervised sale process intended to maximize the company’s value amidst ongoing financial and operational challenges. The announcement also includes the immediate resignation of co-founder and CEO Anne Wojcicki, who will remain on the company’s board and plans to bid on the company’s assets during the bankruptcy proceedings.

Founded in 2006, 23andMe gained prominence by offering direct-to-consumer DNA testing kits that provided insights into ancestry and health predispositions. Despite amassing a customer base exceeding 15 million and forming strategic partnerships, such as its collaboration with pharmaceutical giant GlaxoSmithKline (GSK), the company faced persistent challenges in generating recurring revenue and achieving profitability. In 2021, 23andMe went public with a valuation of $3.5 billion; however, its market capitalization has since plummeted to approximately $50 million.

Operational and Leadership Changes

In response to its financial difficulties, 23andMe implemented a restructuring program in November 2024, which included reducing its workforce by about 40%—approximately 200 employees—and halting the development of all therapeutic programs. These measures were aimed at streamlining operations and conserving resources. The leadership shakeup accompanying the bankruptcy filing sees Chief Financial Officer Joe Selsavage stepping in as interim CEO. Additionally, the company has appointed Matt Kvarda from Alvarez & Marsal as Chief Restructuring Officer and Thomas Walper, formerly of Munger, Tolles & Olson LLP, as an independent director on the board.

By filing for Chapter 11 protection in the U.S. Bankruptcy Court for the Eastern District of Missouri, 23andMe intends to conduct a value-maximizing sale of its assets. The company has secured a debtor-in-possession financing commitment of approximately $35 million from JMB Capital Partners to support ongoing operations during the bankruptcy proceedings. This financing, along with cash generated from continued operations, is expected to sustain the business throughout the sale process.

The court-supervised sale process is anticipated to last 45 days, during which qualified bids will be solicited. If multiple qualified bids are received, an auction will be held to maximize asset value. Any prospective buyer will be required to comply with applicable laws regarding the treatment of customer data, ensuring the protection of sensitive genetic information.

Data Privacy and Customer Concerns

The bankruptcy filing has raised concerns among customers regarding the security and privacy of their genetic data. 23andMe has assured that there will be no changes to how customer data is stored, managed, or protected during the bankruptcy proceedings. The company remains committed to transparency in data management, and any potential buyer will be obligated to adhere to existing privacy policies and legal requirements.

However, some experts have expressed apprehension about the implications of the bankruptcy on data privacy. Given that 23andMe’s privacy statement allows for the transfer of personal information in the event of a merger, acquisition, or sale of assets, customers are advised to stay informed about the proceedings and consider their options regarding data retention or deletion.

In addition to financial woes, 23andMe has faced legal challenges, notably a significant data breach in 2023 that exposed the personal information of approximately 6.9 million customers. The company agreed to a $30 million settlement and offered three years of security monitoring to affected individuals. The Chapter 11 proceedings are expected to address and resolve outstanding legal liabilities stemming from this incident.

Implications for the Genetic Testing Industry

23andMe’s bankruptcy filing underscores the volatility and challenges within the direct-to-consumer genetic testing industry. While the company pioneered accessible DNA testing and brought personalized genomics into mainstream consciousness, its struggles highlight the difficulties in sustaining a profitable business model in this sector. Factors such as market saturation, privacy concerns, and the need for continuous innovation pose significant hurdles for companies operating in this space.

As 23andMe navigates the complexities of bankruptcy and seeks a viable path forward through a court-supervised sale, stakeholders—including customers, employees, and investors—are closely monitoring developments. The outcome of these proceedings will not only determine the future of 23andMe but may also have broader implications for the genetic testing industry and the handling of sensitive consumer data.