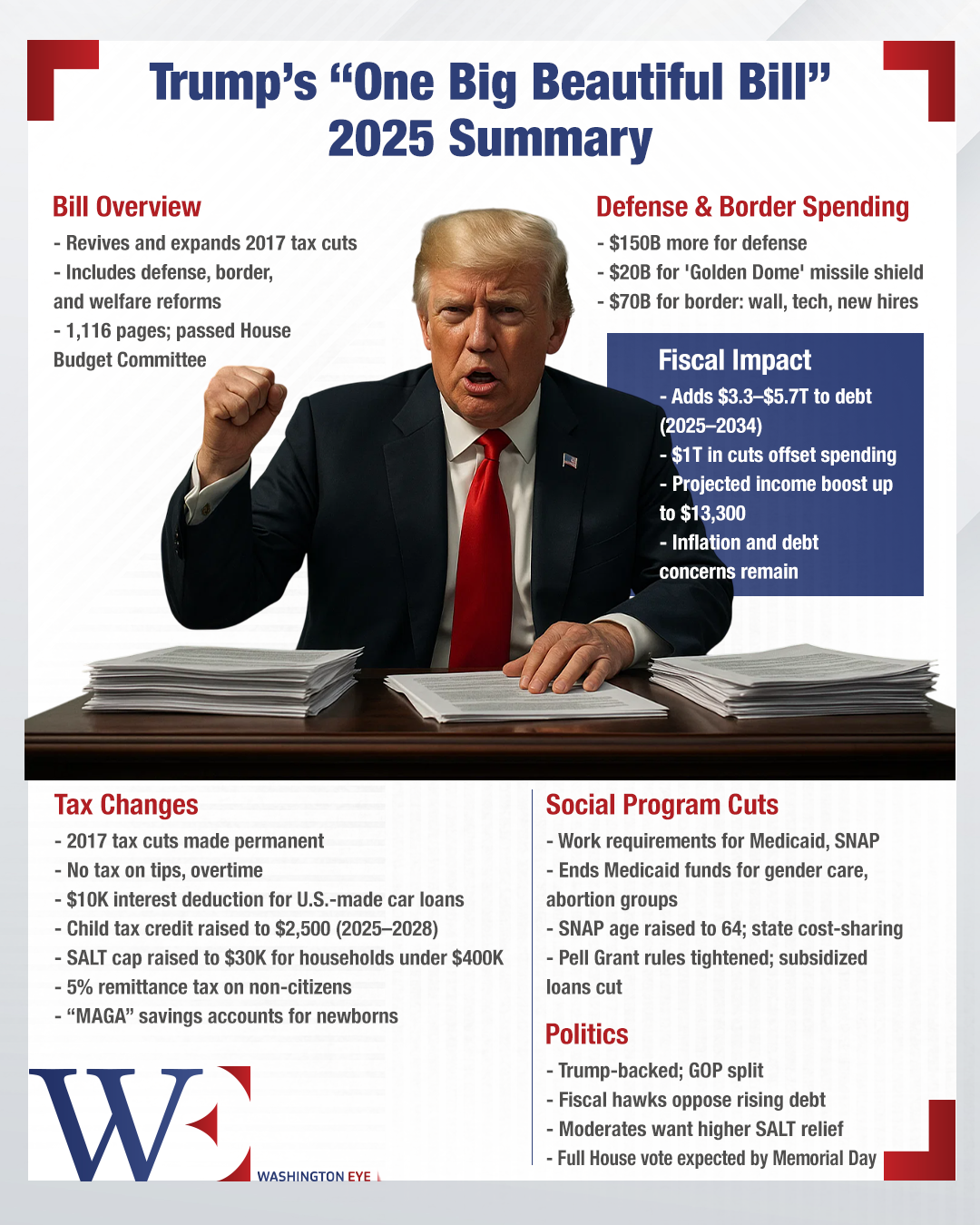

In a dramatic return to Capitol Hill, former President Donald Trump issued a pointed ultimatum to Republican lawmakers: fall in line behind his sweeping new tax-and-spending package, or face the political and economic consequences. That warning proved effective. On May 22, 2025, the U.S. House of Representatives narrowly passed what Trump dubbed the “One Big Beautiful Bill” by a 215–214 vote, marking a major legislative victory and reaffirming his influence in the post-election political landscape.

The bill revives and expands Trump’s 2017 tax cuts while implementing controversial spending reductions. Though initially positioned as a centerpiece of Trump’s campaign before the 2024 election, its passage now serves as a litmus test for Republican unity as the party looks ahead to the 2026 midterm elections.

Internal Divisions and Leadership Tensions

Trump’s private meeting with House Republicans on May 20 set the stage for a high-stakes vote. He warned that failure to pass the bill would amount to enabling a “massive tax increase,” citing the scheduled expiration of key provisions from the 2017 Tax Cuts and Jobs Act. His tone was forceful—reportedly threatening that dissenters would be “knocked out so fast”—signaling his continued willingness to shape primaries through endorsements and political pressure.

Despite the victory, the vote revealed internal fractures. Two Republican lawmakers broke ranks, citing the bill’s projected addition of $3.8 trillion to the national deficit over the next decade. Moderates from high-tax states such as New York and New Jersey succeeded in securing a temporary increase to the state and local tax (SALT) deduction cap, but many still express frustration over the lack of broader reform.

House Speaker Mike Johnson, who embraced Trump’s agenda, is now tasked with managing these divergent factions amid growing expectations from both conservative and centrist wings.

Policy Scope and Strategic Trade-Offs

The legislation permanently extends the 2017 individual and corporate tax cuts, introduces new tax exemptions on tipped wages and car loan interest, and creates “MAGA” savings accounts offering $1,000 per child born during Trump’s current term. It also raises the Child Tax Credit to $2,500 until 2028.

In exchange, the bill enacts significant spending cuts. Work requirements for Medicaid and food stamp recipients are tightened, subsidies for clean energy are scaled back, and an additional $150 billion is allocated to defense and border security. These moves have prompted warnings from both sides—Democrats decry social program cuts, while deficit hawks say the reductions fall short of what’s needed to finance the tax provisions.

Economic Fallout and Global Warnings

Early reactions from economic analysts have been mixed. While proponents argue the bill will stimulate growth and incentivize work, preliminary assessments suggest it could raise the national debt by nearly $4 trillion. With the U.S. debt-to-GDP ratio approaching 100%, international institutions such as the International Monetary Fund have warned against the long-term risks of unfunded tax policies.

Markets responded with caution. Bond yields rose amid expectations of increased federal borrowing, and clean energy stocks fell sharply in response to subsidy rollbacks. Economists are also voicing concerns about renewed inflationary pressures and the potential for reduced investor confidence.

Strategic Calculations Ahead of the 2026 Midterms

With the 2024 election now behind him, Trump is using the bill’s passage to solidify his control over the GOP and position the party for gains in 2026. The legislation is being framed not just as policy, but as a political loyalty test. Republican incumbents who resisted the bill could face primary challengers endorsed by Trump, while those who supported it are being hailed as aligned with the party’s future direction.

Moderate Republicans, particularly those representing suburban districts, face a more complex equation. While they were able to extract certain concessions, such as adjustments to SALT, they remain under pressure from constituents concerned about healthcare, education, and social safety nets. Meanwhile, fiscal conservatives continue to demand deeper cuts as a precondition for future tax reforms.

A Final Note: A Defining Test for Republican Strategy

The passage of the “One Big Beautiful Bill” is more than a legislative milestone—it is a statement of intent from Trump and a blueprint for the Republican Party’s direction heading into the midterms. It highlights the former president’s enduring grip on the party and forces lawmakers to navigate a landscape dominated by ideological purism, fiscal tension, and populist messaging.

As the bill moves to the Senate, where further debate and amendments are expected, its ultimate fate—and the political costs tied to it—will continue to shape both Republican strategy and the broader trajectory of American fiscal policy. The outcome of this legislative gamble may well define the contours of the 2026 midterms, and determine whether the GOP’s alliance with Trump remains an advantage or a liability.