In recent weeks, global financial markets have experienced significant turmoil, with the U.S. stock market alone shedding approximately $4 trillion in value. This downturn has been largely attributed to President Donald Trump’s aggressive trade policies, including escalating tariffs on key trading partners such as Canada, Mexico, and China. The resulting market volatility has raised concerns among investors, particularly those with retirement accounts like 401(k)s and IRAs, as they witness substantial declines in their portfolios.

The Impact of Tariff Policies on Market Stability

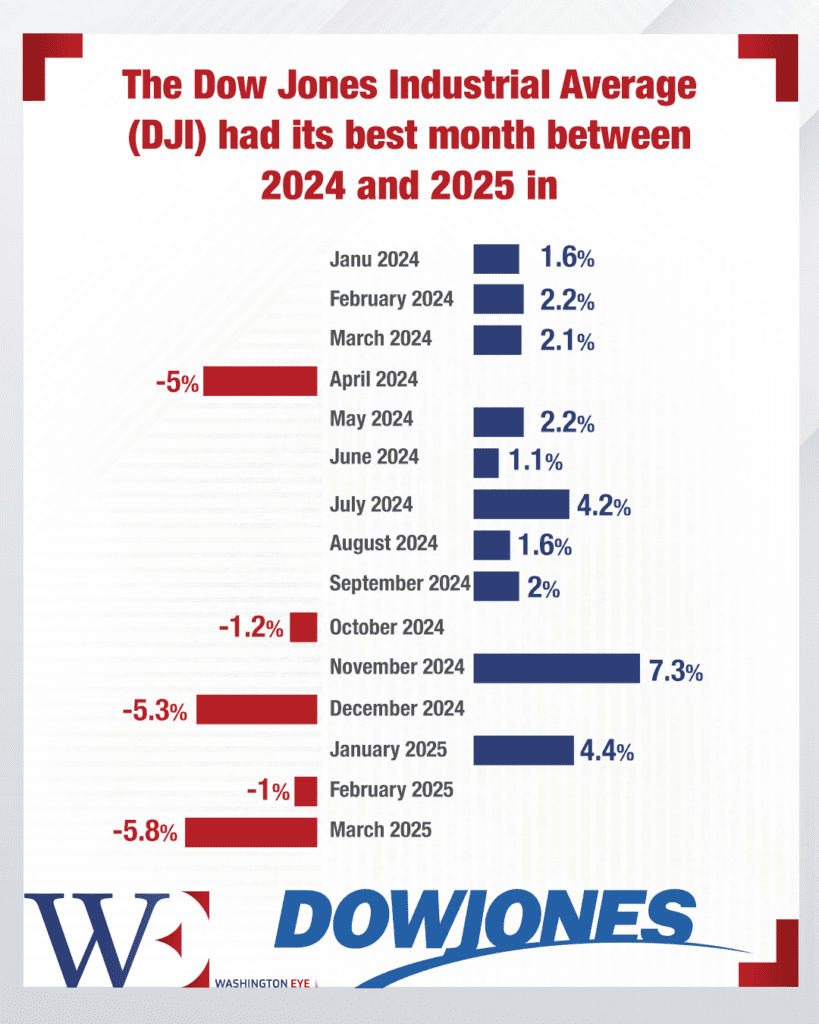

President Trump’s decision to increase tariffs has been a central factor in the recent market decline. Notably, the tariffs on Canadian steel and aluminum imports were raised from 25% to 50% in retaliation for Ontario’s 25% tariff on electricity exports to the U.S. This move contributed to significant market volatility, with the VIX index—a measure of market fear—rising by 4%. Major indices, including the Dow Jones Industrial Average, S&P 500, and Nasdaq, experienced substantial declines, reflecting investor anxiety over escalating trade tensions and potential economic repercussions.

Retirement Accounts Under Pressure

The stock market’s downturn has had a pronounced effect on retirement savings. 401(k) participants have seen their account balances diminish, with the median 401(k) balance dropping from $81,000 to $64,800, representing a significant erosion of retirement funds.

This decline has been particularly concerning for individuals nearing retirement, as the reduced value of their investments may impact their financial security in the years to come. The volatility has also led to increased trading activity within 401(k) accounts. On March 10, trading volumes were more than eight times higher than average, marking the highest level since the onset of the COVID-19 pandemic in 2020. Many investors shifted their assets from equities to more stable options, such as stable value funds, bonds, and money market funds, in an effort to mitigate potential losses.

Investor reactions to the market downturn have been varied. Some individuals remain optimistic, viewing the current situation as a temporary setback. For instance, supporters of President Trump believe that the short-term pain caused by the tariffs will ultimately lead to long-term economic gains. They anticipate that the administration’s policies will result in a more favorable economic environment once the initial disruptions subside.

Conversely, other investors are increasingly concerned about the potential for a recession or stagflation—a combination of stagnant economic growth and high inflation. The unpredictability of the current economic landscape has led some to adopt more conservative investment strategies, focusing on preserving capital rather than seeking growth. This cautious approach reflects broader apprehensions about the sustainability of current economic policies and their long-term implications.

Global Ripple Effects

The repercussions of the U.S. market selloff have extended beyond American borders. International markets, including those in Europe and Australia, have experienced declines as well. For example, the Australian share market saw $49 billion wiped from the ASX 200, leading to negative returns for superannuation funds in February. Despite these setbacks, financial advisors recommend that investors maintain a long-term perspective and avoid making hasty decisions based on short-term market movements.

The recent $4 trillion loss in the U.S. stock market, driven by President Trump’s tariff policies, has had a profound impact on investors, particularly those with retirement accounts.