Oil prices took center stage last week as U.S. President Donald Trump urged the Organization of the Petroleum Exporting Countries (OPEC) to lower prices, claiming that such a move could bring an immediate end to Russia’s war in Ukraine.

Speaking at the World Economic Forum in Davos, Trump stated, “Right now, the price is high enough that that war will continue. You gotta bring down the oil price; that will end that war. You could end that war.”

Trump’s comments underscore his belief that high oil prices are enabling Russia to sustain its military operations by providing critical revenue streams. By urging OPEC to intervene, he hopes to weaken Russia’s financial position and force a resolution to the conflict.

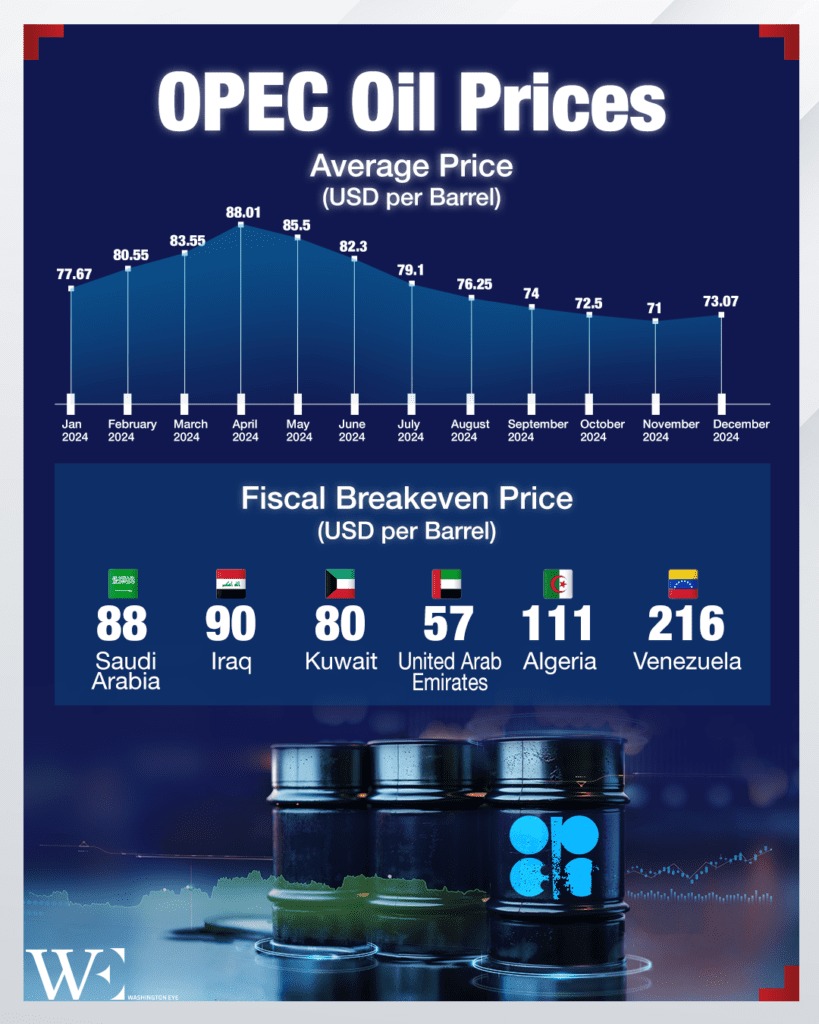

Oil markets reacted swiftly to Trump’s remarks, with Brent crude prices falling by nearly 1%, trading just above $78 per barrel. Market analysts suggest that his statements have injected fresh uncertainty into the sector, raising questions about potential OPEC production adjustments.

OPEC, which has historically managed production to maintain price stability, faces a complex challenge. While some member states may consider accommodating Trump’s request, others, including Russia, could resist any move that threatens their economic interests. Analysts remain skeptical about OPEC’s willingness to comply, noting that current price levels are crucial for the fiscal stability of many oil-producing nations.

Trump also reiterated his commitment to expanding domestic energy production, calling for increased drilling and fracking in the United States. His push for greater energy independence aligns with his broader economic agenda, which includes deregulation and tax incentives aimed at boosting the energy sector.

While Trump’s proposals could lower energy costs and reduce dependence on foreign oil, they also carry significant geopolitical and environmental implications. Increasing U.S. production could strain relations with OPEC nations and raise concerns among environmental advocacy groups regarding the impact of expanded drilling activities.

Trump’s remarks reflect his strategy of leveraging energy and monetary policies to influence global events, particularly the Ukraine conflict. However, whether OPEC will act on his requests remains uncertain, and the broader geopolitical landscape continues to evolve with multiple economic and strategic considerations in play.