In a dramatic response to escalating global trade tensions, gold prices have surged to unprecedented levels, reaching a record high of $3,248 per troy ounce on April 11, 2025. This surge follows President Donald Trump’s announcement of sweeping tariffs on imports from multiple countries, a move that has sent shockwaves through global financial markets.

On April 2, 2025, President Trump unveiled a series of tariffs, including a 34% levy on Chinese goods, 20% on European Union exports, and a 10% base rate on imports from the United Kingdom and other nations. These measures, described by the administration as “reciprocal tariffs,” aim to address perceived trade imbalances but have raised concerns about a potential global economic slowdown.

The immediate market reaction was stark. The S&P 500 experienced a 4.8% drop, marking its most significant one-day decline in five years. The tech-heavy Nasdaq Composite fell nearly 6%, while the Russell 2000, representing small-cap stocks, declined by 6.7%. Collectively, U.S. stocks saw over $3.1 trillion in market value erased during the session.

Amid this financial turbulence, investors sought refuge in traditional safe-haven assets, with gold emerging as a primary beneficiary. The precious metal’s price climbed to an all-time high of $3,167 per troy ounce, reflecting its role as a hedge against market volatility and inflationary pressures stemming from the newly imposed tariffs.

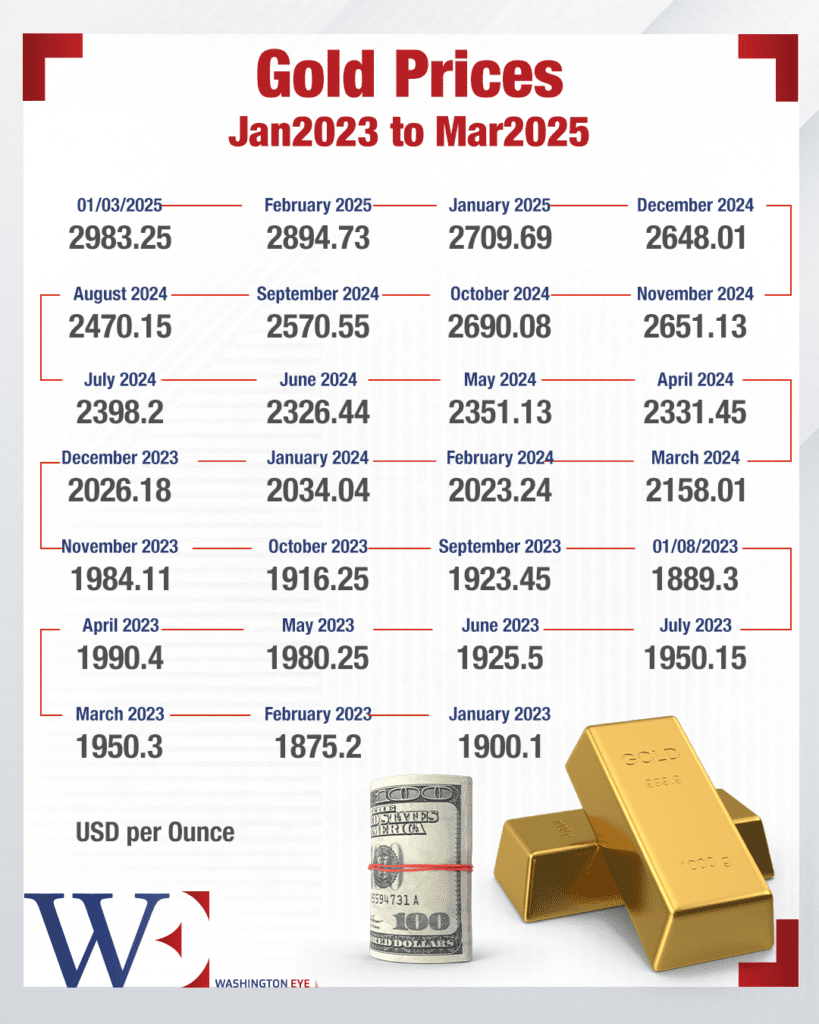

The surge in gold prices is part of a broader trend observed throughout 2025. Earlier in the year, on March 31, gold surpassed the $3,100 mark, driven by investor concerns over inflation linked to tariff announcements. This increase marked gold’s strongest quarterly performance since 1986, with spot gold reaching $3,128.06 and U.S. gold futures settling at $3,151.10 per ounce.

Analysts attribute the rising demand for gold to several factors, including geopolitical uncertainties, fears of an economic slowdown, and increased central bank purchases. Major financial institutions have adjusted their forecasts accordingly. Goldman Sachs, for instance, revised its gold price outlook upward, projecting that gold could surpass $4,500 within the next 12 months under extreme market conditions.

The tariffs have also had significant implications for other financial instruments. U.S. Treasury bonds experienced a rally, with yields on 10-year Treasuries falling as investors moved towards safer assets. Conversely, the U.S. dollar weakened, and oil prices declined by 3%, signaling concerns over global economic activity.

Internationally, the response has been one of apprehension and preparation for potential retaliatory measures. The European Union and China have indicated possible countermeasures, raising the specter of a full-scale trade war. Economists warn that such developments could exacerbate inflationary pressures and potentially lead to stagflation—a scenario characterized by stagnant growth coupled with rising inflation.

In the face of these uncertainties, investors are advised to consider diversifying their portfolios to mitigate risks. Financial experts suggest allocating assets towards bonds, gold, and defensive stocks in sectors like consumer staples, healthcare, and utilities. These sectors have historically demonstrated resilience during periods of market volatility.

While the immediate future remains uncertain, the current trajectory suggests that gold may continue to play a pivotal role as a safe-haven asset. As trade tensions persist and economic indicators fluctuate, market participants will closely monitor developments, adjusting their strategies to navigate the evolving financial landscape.