A System at its Boiling Point

The Washington Eye

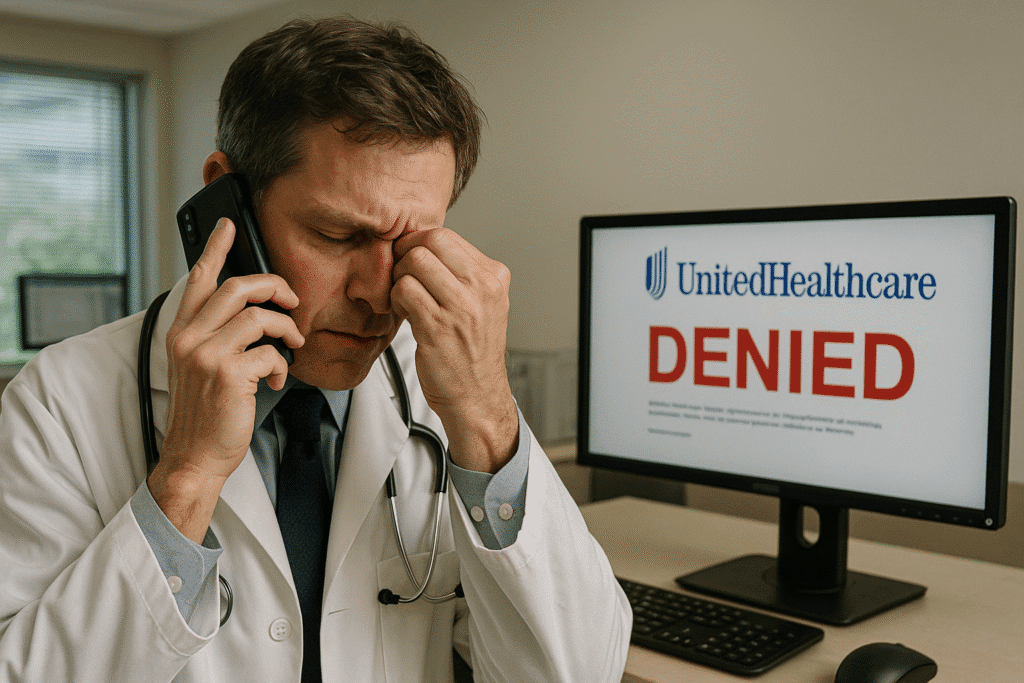

It began, as many modern conflicts do, with a post on social media. Dr. Zachary Levy, a New York emergency physician, took to X, formerly Twitter, with an explosive claim: UnitedHealthcare had denied coverage for his patient in the intensive care unit. The patient was in a coma, suffering from a brain hemorrhage, on a ventilator, and in heart failure. The reason for the denial, according to Dr. Levy, was that he had not yet proven to the insurer that this critical care was “medically necessary”. The post was viewed more than 13 million times before Levy’s account was deleted, a testament to its raw, resonant power.

Weeks later, another story ignited the digital firestorm. Dr. Elisabeth Potter, a Texas surgeon, posted a video claiming she had to scrub out mid-surgery on a breast cancer patient to argue with a UnitedHealthcare representative over an inpatient stay justification—for a patient already unconscious on the operating table. These viral moments were not isolated grievances; they were declarations of war in a long-simmering conflict, erupting in the superheated atmosphere following the fatal shooting of UnitedHealthcare CEO Brian Thompson on December 4, 2024.

That event opened what many observers called the “floodgates of Americans venting insurance frustrations”. Instead of sympathy, social media platforms filled with expressions of anger and resentment, with comments like “My empathy is out of network” becoming commonplace. The words found on ammunition at the scene—”delay,” “deny,” and “depose”—became a rallying cry, perfectly encapsulating the public’s perception of insurer tactics. This profound lack of public sympathy signals a dangerous level of systemic delegitimization, suggesting the perceived injustices of the healthcare financing system are so severe they have begun to erode fundamental social norms and trust in core institutions.

The Anatomy of Frustration: Deconstructing the Denial Machine

At the heart of the daily battle between physicians and insurers is a process known as prior authorization (PA). In theory, it is a cost-control measure where doctors must get pre-approval from an insurer before providing a service or prescribing a medication. For physicians, however, PA has become a “bureaucratic headache” that delays patient care. A survey by the American Medical Association (AMA) found that 94% of physicians report that PA requirements delay patient access to necessary care.

A particularly galling component is the “peer-to-peer” review, where a treating physician must justify their clinical decision to a doctor employed by the insurance company. Physicians describe it as a charade, reporting lengthy calls with “peers” from unrelated specialties—a pediatrician arguing with a neurologist, for instance—who often have no real authority to overturn the initial denial. This process appears to be less a clinical check-and-balance and more a bureaucratic ritual designed to create friction and incentivize physicians to choose a less optimal but pre-approved alternative.

Beyond the daily grind of PA, physicians allege a more deliberate strategy of “delay, deny, and underpay.” This accusation has moved from anecdotal complaints to formal legal challenges. A federal lawsuit filed by SpecialtyCare physicians against UnitedHealthcare explicitly accuses the company of this pattern, alleging UHC deliberately delays payments for out-of-network services well beyond the legally mandated 30-day deadline, resulting in over $900,000 in unpaid awards to SpecialtyCare alone. The lawsuit contends this is not an error but a profitable business model, alleging UHC knows that it and its shareholders “profit from” its lack of compliance. Other major insurers, such as Anthem, have also faced accusations of being behind on billions of dollars in payments to hospitals.

The Ghost in the Machine: Automated Denials and Algorithmic Medicine

The conflict has been dramatically escalated by the insurance industry’s growing reliance on artificial intelligence to process claims. A U.S. Senate subcommittee report accused UnitedHealthcare of leveraging AI to automate PA denials for post-acute care, causing the denial rate for such services to more than double between 2020 and 2022. This practice is now the subject of a class-action lawsuit alleging that UHC illegally used an AI model with a reported 90% error rate to override physician judgment, banking on the fact that only 0.2% of policyholders ever appeal a denial.

This approach was famously exposed in a landmark ProPublica investigation into Cigna’s “PXDX” system. The report revealed the system allowed Cigna’s medical directors to deny claims in bulk without ever opening patient files. Over a two-month period, Cigna doctors rejected more than 300,000 claims, spending an average of just 1.2 seconds on each case. A former Cigna medical director described the process bluntly: “We literally click and submit. It takes all of 10 seconds to do 50 at a time”.

The use of these automated systems represents a fundamental redefinition of “medical review.” These AI systems do not review individual files; they simply flag mismatches between diagnosis codes and pre-approved procedure lists. The human “review” is reduced to a procedural formality of a doctor electronically signing off on batches of algorithmic denials. The legal fallout has been significant, with the House Committee on Energy and Commerce launching an investigation into Cigna’s PXDX system and a federal judge stating that allowing an algorithm to make the decision “conflicts with the plain language of the plan and constitutes an abuse of discretion”.

The Human Toll: Quantifying the Impact

The consequences of these insurer practices are measured in human suffering. An AMA poll found that 33% of physicians reported a “serious adverse event” for a patient in their care due to prior authorization delays, including hospitalization, permanent disability, or even death. This is tragically illustrated by cases like that of a patient whose tonsil cancer progressed from Stage 1 to Stage 2 during a three-week wait for a PET scan approval. For many, the fight is too much; physicians report that 78% of patients ultimately abandon a recommended course of treatment due to struggles with their insurer.

This daily battle is also fueling an epidemic of burnout among physicians. Medical practices spend an average of 14 hours per week—the equivalent of two full business days—on prior authorizations alone, forcing more than a third of practices to hire staff dedicated to fighting for these approvals. This administrative load represents a direct transfer of labor costs from the insurer to the provider. This uncompensated labor, combined with the “moral injury” of watching patients suffer, is a primary driver of the burnout crisis, with one in five doctors now planning to leave their practice within two years.

The Insurer’s Gambit and the Counter-Offensive

In their defense, insurance companies argue they are a necessary bulwark against runaway healthcare spending, working to “tamp down” soaring costs. UnitedHealthcare states that it “approves and pays about 90 percent of medical claims upon submission” and that only a tiny fraction of denials are for clinical reasons. This public posture is starkly contrasted by the companies’ market power. UnitedHealth Group’s Optum subsidiary is now the largest employer of physicians in the country, controlling one in ten U.S. doctors, a vertical integration that has triggered a Department of Justice antitrust investigation.

When physicians like Dr. Potter challenge them publicly, the response can be overwhelming. UnitedHealthcare accused her of spreading “dangerous misinformation for social media clout” and retained Clare Locke, the high-profile defamation law firm that successfully represented Dominion Voting Systems against Fox News, to demand she recant her statements. This sends a chilling message to other physicians against speaking out.

The battle has now expanded far beyond social media. Provider groups are shifting to organized legal action, like the SpecialtyCare lawsuit using the No Surprises Act to challenge UHC’s entire “delay, deny, and underpay” apparatus. This legal pressure is amplified by intense government scrutiny and shareholder activism, with groups like the Interfaith Center on Corporate Responsibility filing petitions demanding reports on the public health impact of denial practices. This multi-front assault constitutes a systemic challenge to the dominant health insurer model.

An Irreconcilable Conflict?

The vitriol expressed by physicians on social media is a symptom of a deep, structural conflict. There is a “universal feeling” among doctors that “insurance companies are working against us,” transforming a financial check-and-balance into a system that appears to penalize both patients and physicians to increase shareholder profits. While legislative reforms are being pursued, the fundamental battle continues to be waged in the court of public opinion. As ophthalmologist and social media personality Dr. Will Flanary (Dr. Glaucomflecken) notes, public advocacy is one of the only ways “to put a significant amount of pressure on these corporations who are doing bad things for patients”. The conflict is escalating in courtrooms and boardrooms, but it began—and continues to be fought—in the public square, one viral post at a time.

At The Washington Eye, we investigate the untold stories shaping U.S. foreign policy.