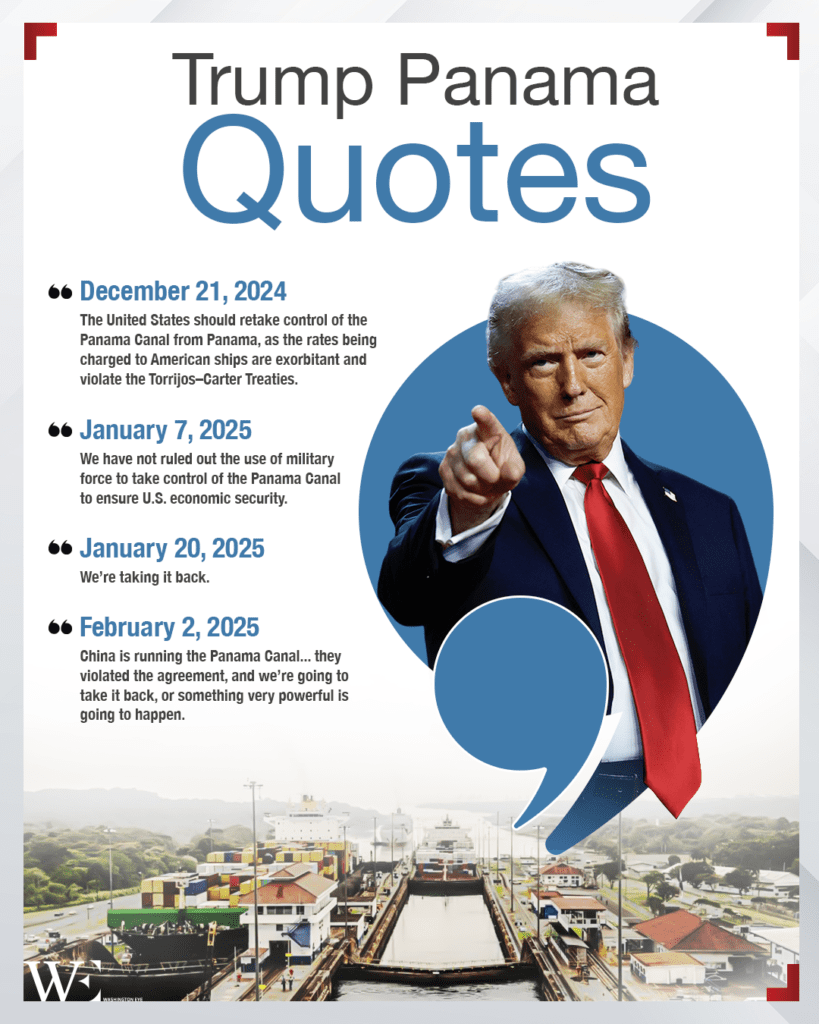

The geopolitical battle for influence in Latin America has taken a decisive turn, with the United States intensifying efforts to regain strategic control over Panama and, most crucially, the Panama Canal. A key artery for global trade, the canal is once again at the centre of a high-stakes power struggle between Washington and Beijing.

President Donald Trump’s recent declaration of intent to “reclaim the Panama Canal” signals a broader U.S. strategy aimed at curbing China’s expanding footprint in Latin America. Since the canal was handed over to Panama in 1999, Chinese companies have steadily increased their economic presence, securing critical infrastructure projects and port operations. Now, with an assertive push from Washington, Panama appears to be realigning its geopolitical stance in favour of U.S. interests.

BlackRock’s Acquisition of Key Panamanian Ports

A pivotal development in this geopolitical manoeuvring is BlackRock’s acquisition of key ports in Panama, a deal that underscores Washington’s intent to counter Chinese influence in the region. The acquisition, however, is not just limited to Panama; it extends to ports owned by Hong Kong-based CK Hutchison Holdings, one of the largest global port operators.

BlackRock, a major U.S. asset management firm with close ties to the U.S. government, secured a majority stake in Hutchison’s Latin American port operations, including key terminals flanking both sides of the Panama Canal. This acquisition effectively places crucial maritime trade infrastructure back under U.S.-aligned control, weakening China’s economic grip on the region.

Hutchison’s involvement in Panama has long been a point of contention for U.S. policymakers, particularly given concerns over Beijing’s strategic use of state-backed companies to expand its global economic influence. By taking over these ports, BlackRock has shifted control away from Chinese interests and reinforced the United States’ presence in one of the world’s most important shipping routes.

The deal is widely seen as a direct response to China’s Belt and Road Initiative (BRI), which has fueled large-scale investments in Latin America, including in Panamanian infrastructure. The timing of this acquisition—coinciding with broader U.S. diplomatic efforts to pull Panama out of the BRI—raises questions about Washington’s long-term objectives and the extent to which U.S. financial and political influence is shaping Latin America’s economic policies.

Panama’s Withdrawal from China’s Belt & Road Initiative

Panama’s decision to withdraw from China’s Belt & Road Initiative marks a significant shift in its foreign policy. President José Raúl Mulino announced the move following high-level discussions with U.S. Secretary of State Marco Rubio, signalling a sharp pivot away from China.

Panama was one of the first Latin American nations to join the BRI in 2017, a decision that rapidly expanded economic ties between Panama and China. Over the past seven years, Beijing has become a key trade partner, investing in major infrastructure projects, including ports, logistics hubs, and telecommunications. However, growing concerns over debt dependency, along with mounting U.S. pressure, appear to have influenced Panama’s leadership to rethink its alliance with Beijing.

Washington’s opposition to the BRI is well-documented, with U.S. officials frequently warning Latin American nations about the potential economic risks of Chinese-funded projects, including unsustainable debt burdens and strategic vulnerabilities. With Panama’s withdrawal, the U.S. has scored a significant diplomatic victory, reinforcing its influence in the region while weakening China’s economic foothold.

Future Infrastructure Developments: The Panama-David Railway

One of the major infrastructure projects affected by this strategic shift is the proposed Panama-David railway, a $5 billion initiative originally planned with Chinese support. Feasibility studies for the railway were conducted by China Railway Design Corporation, but with Panama’s realignment toward the U.S., the project has undergone a dramatic change in direction.

The Panamanian government has now commissioned U.S.-based Aecom to develop a new master plan for the railway, a move that ensures American companies will play a leading role in the project’s execution. This shift aligns with Washington’s broader goal of securing critical infrastructure investments in Latin America, ensuring that strategic transportation projects remain within the U.S. economic sphere of influence.

The Panama-David railway is a crucial development for Panama’s domestic economy, intended to improve connectivity between the capital and the country’s western provinces. The project’s transition from Chinese to American oversight is yet another indicator of the shifting power dynamics in the region.

Challenges and Potential Risks for the U.S.

Despite these strategic gains, the U.S. faces several challenges in consolidating its influence in Panama. China still holds substantial stakes in various Panamanian ventures, including Cobre Panamá, one of the largest copper mines in the world. This mine, operated by First Quantum Minerals with significant Chinese investment, represents a crucial component of Panama’s economy.

Beyond Panama, other Latin American countries are closely monitoring these developments. China remains a vital trade partner for much of the continent, and while U.S. investments are welcomed, there is unease about the long-term economic implications of shifting allegiances too abruptly. Latin American economies, heavily reliant on trade with both superpowers, must carefully navigate this growing geopolitical rivalry to ensure financial stability.

Moreover, while BlackRock’s acquisition of Panama’s port infrastructure strengthens U.S. control over the canal’s logistics network, it also raises concerns about increased American corporate influence in the region. Latin American governments, including Panama, have historically sought to balance foreign economic partnerships to avoid over-dependence on any single power. The increasing presence of U.S. financial entities could create domestic pushback if seen as another form of economic imperialism.

A Coordinated U.S. Strategy or Coincidence?

The convergence of these events—Trump’s declaration on the Panama Canal, BlackRock’s acquisition of key ports, and Panama’s exit from the BRI—raises important questions about the timing and coordination of U.S. foreign policy in the region.

Is this simply a series of independent decisions that happened to align, or is it a well-orchestrated strategy by Washington to systematically dismantle China’s influence in Latin America?

While the U.S. has long viewed Latin America as its strategic backyard, China’s economic expansion over the past two decades has altered the geopolitical landscape. With Washington now taking an aggressive stance to reassert control over key assets like the Panama Canal, the region is once again becoming a focal point of great-power competition.

For Panama, the stakes are high. By distancing itself from Beijing and strengthening ties with Washington, it may gain financial and diplomatic benefits in the short term, but it also risks alienating a key economic partner. The challenge for President Mulino will be to navigate this delicate balance, ensuring that Panama maximizes its strategic position without becoming overly reliant on either power.