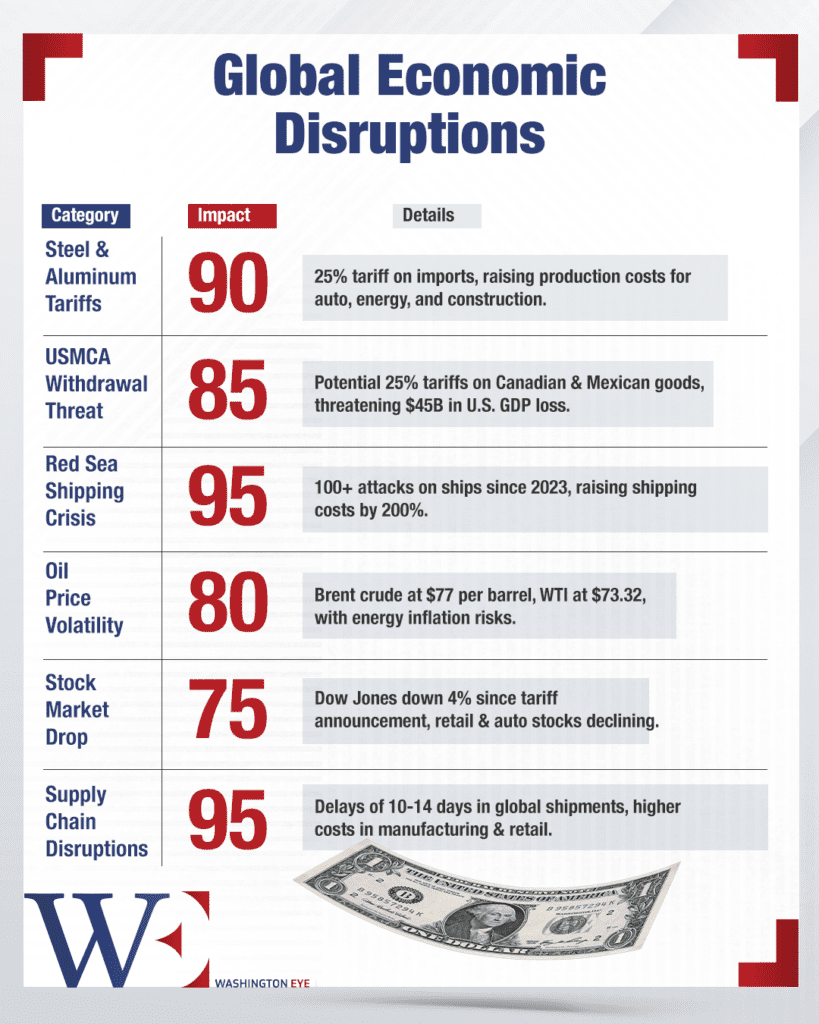

The global economy is experiencing a seismic shift as the United States reverts to aggressive protectionism under President Donald Trump. His “America First” policies are reconfiguring global trade, with sweeping tariffs, threats to withdraw from trade agreements, and intensifying geopolitical conflicts. At the same time, the Red Sea crisis continues to disrupt global shipping routes, while oil prices fluctuate amid U.S. energy expansion efforts.

The question now is whether this shift will strengthen the U.S. economy or backfire, leading to supply chain chaos, inflation, and global instability.

The Tariff Shock: Steel, Aluminum, and a Trade War in the Making

On February 1, 2025, President Trump reinstated a 25% tariff on all steel and aluminum imports, aiming to protect domestic manufacturers from foreign competition. The White House framed the move as a necessary measure to ensure “economic sovereignty”, but major industries are already feeling the heat.

The automotive, construction, and energy sectors, which depend heavily on these materials, are seeing costs soar. Ford and General Motors have warned of price hikes on vehicles, while Coca-Cola has signaled it may alter packaging to reduce aluminum usage. The renewable energy sector, which relies on imported steel for wind turbines and solar farms, faces higher costs and project delays.

Internationally, the backlash has been swift. Canada, Mexico, and the European Union—major steel and aluminum exporters to the U.S.—are preparing retaliatory tariffs. The European Commission is specifically targeting American whiskey, motorcycles, and agricultural exports. Canada, America’s largest supplier of aluminum, has vowed to challenge the tariffs at the WTO.

The immediate economic effects are significant:

- Construction costs are climbing, making infrastructure projects more expensive.

- Retailers like Amazon and Walmart anticipate higher import costs, potentially raising consumer prices.

- U.S. exports are at risk of retaliatory tariffs, which could hit American farmers and manufacturers hard.

The biggest looming question is whether the U.S. will go further and dismantle the United States-Mexico-Canada Agreement (USMCA).

USMCA on the Brink of Collapse?

President Trump has repeatedly threatened to withdraw from the USMCA, calling it a “bad deal for American workers.” This trade pact, originally renegotiated in 2020 to replace NAFTA, has been crucial in facilitating seamless trade between the U.S., Mexico, and Canada.

The impact of such a withdrawal would be catastrophic for industries with deeply integrated supply chains, such as:

- The automotive sector, where parts cross North American borders multiple times before final assembly.

- Agriculture, where farmers rely on tariff-free access to Canadian and Mexican markets.

- Energy and manufacturing, which depend on North American raw materials.

Economic Forecasts:

According to a Brookings Institution report, if the U.S. imposes a 25% tariff on Mexican and Canadian imports, it could slash 0.25 percentage points off U.S. GDP growth, amounting to a $45 billion loss in economic output. Additionally, analysts predict over 177,000 American jobs could be lost due to higher costs and declining exports.

Canada and Mexico have made it clear they will retaliate, likely targeting U.S. agricultural exports such as soybeans, dairy, and beef. Canada has already hinted at increasing trade with the European Union instead of the U.S.

A USMCA collapse would disrupt supply chains, increase inflation, and force businesses to reconsider manufacturing locations, potentially pushing production to Asia or Europe.

Red Sea Crisis: Global Shipping in Chaos

Beyond North America, another major trade crisis is unfolding in the Red Sea. Houthi rebels in Yemen, backed by Iran, have launched over 100 attacks on commercial vessels since November 2023, forcing many shipping companies to avoid the Red Sea altogether.

The alternative? A much longer and costlier journey around the Cape of Good Hope, bypassing the Suez Canal entirely. The Suez, which handles 12% of global trade, is seeing a sharp decline in traffic as companies prioritize safety over speed.

Consequences for Global Trade:

- Shipping costs have surged by nearly 200% for goods transported between Asia and Europe.

- Delivery times for essential products like electronics and oil have increased by 10-14 days.

- Retail and manufacturing industries are bracing for supply shortages due to shipment delays.

While oil executives have cautiously suggested resuming Red Sea navigation, security analysts warn that the risk of renewed attacks remains high, especially if conflicts in Gaza and Yemen escalate.

Oil Prices and the ‘Drill, Baby, Drill’ Strategy

At the same time, oil markets remain volatile. As of February 11, 2025, Brent crude oil is trading at $77 per barrel, with West Texas Intermediate (WTI) at $73.32 per barrel.

Trump’s ‘Energy Independence’ Plan

Despite the geopolitical tensions, Trump’s energy policy remains clear: “Drill, Baby, Drill.” The administration has accelerated offshore drilling approvals, encouraged new fracking projects, and expanded oil production in Alaska and the Gulf of Mexico.

Economic Impact:

- Increased domestic drilling could drive oil prices lower in the long term, potentially stabilizing inflation.

- However, the energy transition may suffer, as subsidies for renewables are reduced in favor of fossil fuel development.

- U.S. oil exports could rise, but Red Sea instability still threatens global supply chains, making shipping more expensive.

The Energy Information Administration (EIA) projects that Brent crude prices will average $74 per barrel in 2025 before declining to $66 per barrel in 2026. This suggests that, while Trump’s policies may increase U.S. oil supply, they might not prevent global oil market instability caused by geopolitical crises.

A Supply Chain Nightmare

With tariffs, trade wars, and global shipping disruptions converging at once, the impact on global supply chains is already severe.

Key sectors facing turmoil:

- Automotive: Rising steel and aluminum costs threaten production, while supply chain disruptions could cause delays in car manufacturing.

- Retail & E-commerce: Higher shipping fees and longer delivery times will make imported goods more expensive for consumers.

- Energy: While U.S. oil production is increasing, global transportation bottlenecks could keep prices volatile.

The Dow Jones Industrial Average has dropped 4%, reflecting investor fears of a slowing economy and inflationary pressures. The U.S. dollar has weakened, as uncertainty over trade policies rattles global markets.

What’s Next?

Three Major Issues to Watch in 2025:

- Canadian and EU Retaliation: If Canada and Europe impose counter-tariffs, U.S. industries and farmers will face economic retaliation.

- USMCA Negotiations: If Trump moves to dismantle the trade pact, expect North American industries to scramble for alternatives.

- Red Sea Security: If the crisis worsens, shipping costs will remain high, further driving inflation.

A New Economic Reality

Trump’s return has marked a decisive break from decades of globalization. The U.S. is doubling down on protectionism, prioritizing domestic industry at the expense of free trade agreements.

The world must now adapt to an economic order where tariffs, disrupted supply chains, and geopolitical instability shape market forces.

Whether Trump’s policies will strengthen the U.S. economy or cause global economic instability remains one of the biggest questions of 2025.