The rapid rise of Chinese artificial intelligence (AI) technology has sent ripples through global markets, with U.S. tech stocks facing sharp declines. Recent developments highlight China’s aggressive investment in AI and its potential to alter global market dynamics, leaving U.S. investors and companies grappling with uncertainty.

China’s AI Advances: Key Drivers of the Surge

China has made significant strides in AI, driven by substantial government support, a vast pool of data, and breakthroughs in generative AI technologies. Notably, Chinese companies like DeepSeek are now offering AI solutions at a fraction of the cost of their U.S. counterparts. DeepSeek’s recent announcement of high-performing AI tools priced significantly lower than U.S. alternatives has raised concerns about market share erosion for American tech giants. This affordability and quality improvement are reshaping competitive dynamics globally.

U.S. Stock Market Reactions

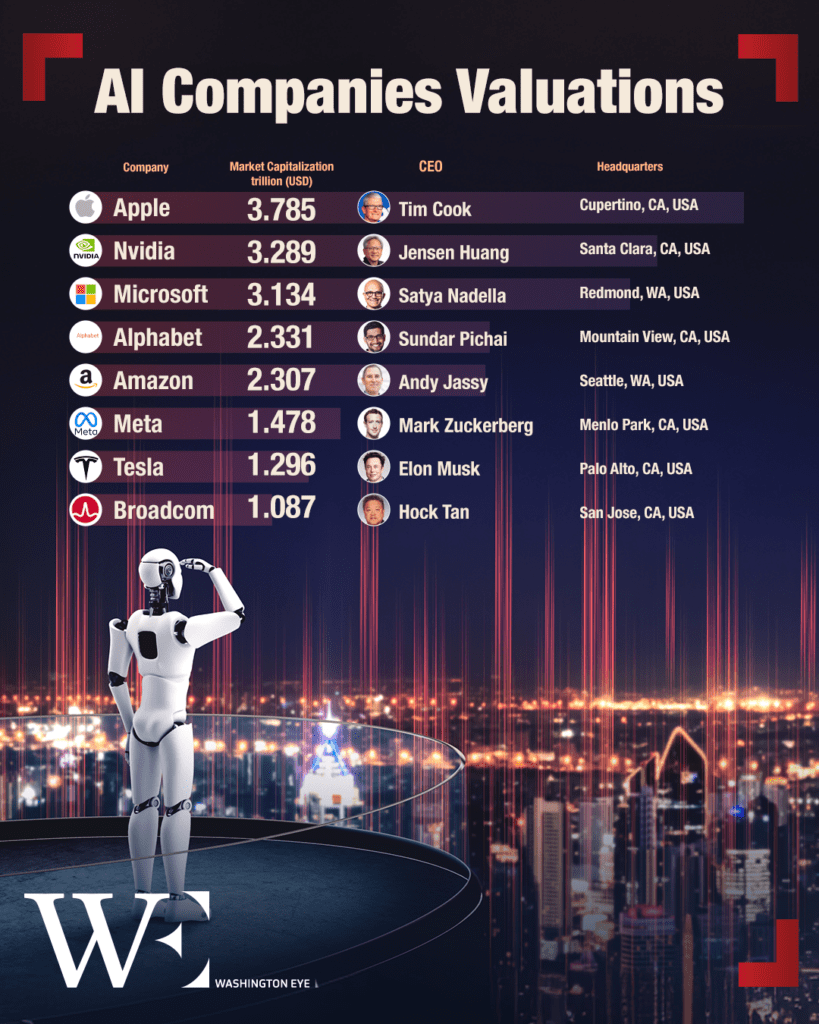

The National Association of Securities Dealers Automated Quotations (Nasdaq), a major U.S. stock exchange known for its focus on technology companies, saw a sharp decline of nearly 3% on January 27, as fears over China’s AI push rattled investors. Companies like Nvidia, Microsoft, and Alphabet, which are heavily reliant on their dominance in the AI space, experienced notable stock dips.

Market analysts cited growing apprehension that Chinese AI firms could undercut U.S. businesses, both in cost and technological sophistication. These fears have been compounded by concerns over potential export restrictions and increasing geopolitical tensions, which could hinder the global reach of U.S. companies.

Geopolitical Implications: Tech Dominance and Trade Wars

China’s ascendancy in AI not only poses economic challenges but also has potential to raise geopolitical tensions. The U.S. has historically maintained a stronghold in AI innovation, but China’s rapid progress could tilt the balance.

U.S. policymakers are already exploring measures to counteract this shift, including tighter export controls and expanded subsidies for domestic AI firms.

This emerging “AI cold war” mirrors the broader competition between the two nations, further complicating trade relations and investment strategies.

The Broader Implications for Tech Investors

The rise of Chinese AI signals a potential restructuring of the global tech landscape. Investors are increasingly wary of overexposure to U.S. tech stocks, which have long dominated portfolios. Instead, many are diversifying, exploring opportunities in non-U.S. markets and alternative technologies.

The long-term winners in this competitive environment will be companies that can innovate at scale while maintaining cost-efficiency.

Whether U.S. firms can adapt quickly enough remains an open question.

Final Remarks: Navigating a New Era of AI Competition

The rise of Chinese AI is not just a technological story but a profound economic and geopolitical shift. While U.S. firms have traditionally led the AI race, the competitive pressure from China’s advancements could force a recalibration of strategies. For investors, the message is clear: adaptability and global awareness are now more crucial than ever in navigating this rapidly evolving landscape.

As the AI arms race intensifies, markets will be watching closely to see how U.S. companies and policymakers respond to this formidable challenge from the East.