The path to homeownership in the United States is becoming increasingly arduous, resembling a formidable climb rather than a straightforward aspiration. Once heralded as the land of prosperity and opportunity, the reality today is stark: fewer Americans can afford homes, even with mortgage assistance. Concerns are mounting that younger generations may find themselves permanently priced out of the housing market, with severe implications for personal and family stability. Economist Javier Vivas describes the situation as a “perfect storm for increased competition and an affordability crisis,” citing rising demand, limited inventory, and surging housing costs. He further explains, “Even though demand has been impacted by a weaker job market, supply has fallen even more,” creating an exclusionary housing environment for younger buyers.

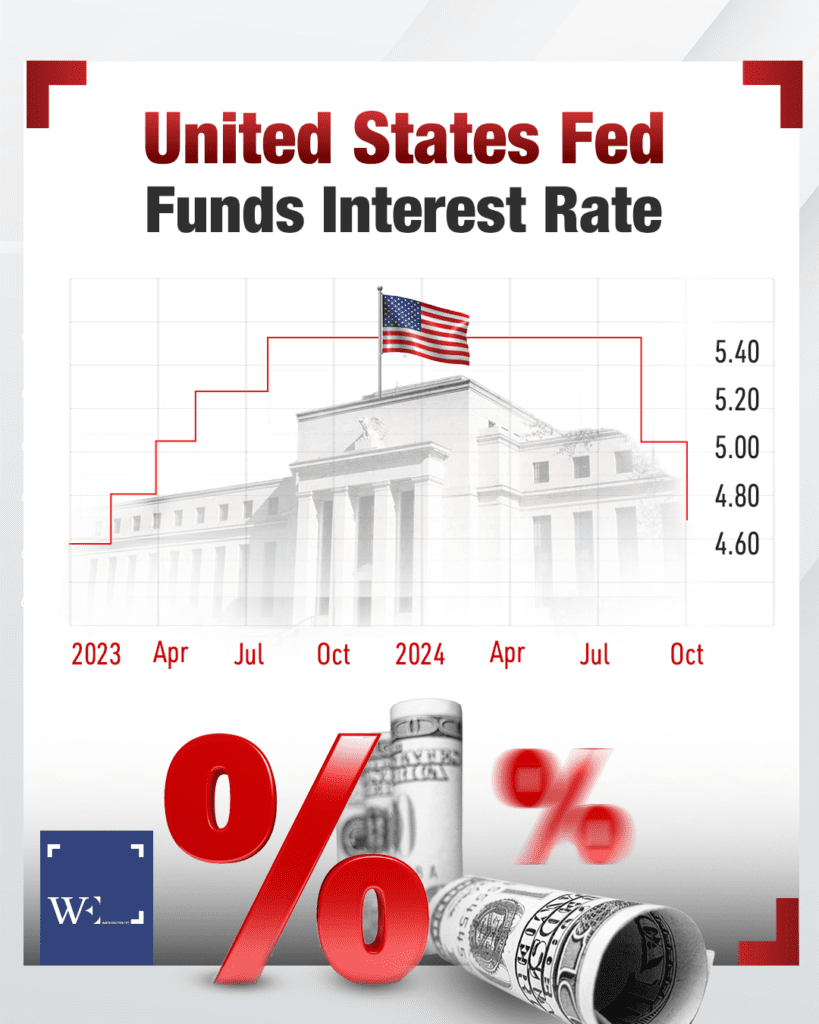

The Federal Reserve and Rising Interest Rates

At the heart of the issue lies inflation. The soaring cost of goods and services has rippled through the construction market, exacerbating already steep housing costs. In response, the Federal Reserve raises interest rates to combat inflation, a necessary measure but one that comes with significant trade-offs. Higher rates make borrowing more expensive, driving up mortgage costs and pushing monthly repayments beyond reach for many.

The uncertainty in today’s job market compounds these challenges. Securing a mortgage—a long-term financial commitment—requires a stable job and reliable income. Yet even established tech giants like Amazon, Google, and Meta have laid off thousands of employees with little warning, eroding consumer confidence. For many, homeownership now feels like an option reserved for those with diversified income streams or significant financial security.

Navigating Complex Market Forces

Rising mortgage rates, driven primarily by Federal Reserve policies, play a pivotal role in shaping the housing market. As rates increase, demand softens, but a limited housing supply keeps prices elevated. High construction costs and supply chain disruptions continue to choke new housing development, further tightening supply.

The strength of the U.S. dollar adds another layer of complexity. As the global reserve currency, fluctuations in its value directly impact the cost of imported materials such as lumber, steel, and concrete. A weaker dollar drives up construction costs, leaving developers with higher financial burdens and fewer projects breaking ground.

Inflation intensifies the crisis further. As prices rise, saving for a down payment becomes increasingly difficult, while higher interest rates limit borrowing power. Many prospective buyers are left in limbo, delaying or abandoning their homeownership goals altogether.

The convergence of these forces—rising borrowing costs, constrained supply, inflation, and economic uncertainty—paints a sobering picture for the U.S. housing market. For many, the dream of homeownership is not just delayed but increasingly out of reach.

A Nation of Renters

With homeownership becoming less attainable, renting is becoming the default option for many Americans. Urban centres, in particular, are experiencing surging rental demand, driving prices higher and intensifying competition. Millennials and Gen Z, facing steep housing costs, are increasingly delaying or abandoning homeownership plans, giving rise to the so-called “Boomerang Generation”—young adults returning to live with family as a financial necessity.

This shift reflects a profound change in housing trends, as saving for a down payment or qualifying for a mortgage becomes an insurmountable challenge for many.

The Shift Towards Affordable Housing Alternatives

Faced with rising costs, prospective buyers are exploring more affordable options, such as smaller homes, townhouses, and condos. The rise of remote work has enabled some to relocate to suburban or rural areas, where housing is less expensive and space more abundant.

Others are turning to shared housing arrangements, such as co-living or renting with roommates, as a practical response to unaffordable rents and mortgages. These trends highlight how the definition of “home” is evolving in response to economic pressures.

The Growing Wealth Divide

The housing market has historically been a key indicator of economic health, but rising interest rates and escalating property prices are deepening inequality. Lower-income households and minority communities, already facing barriers such as limited credit access, are disproportionately affected.

Meanwhile, wealthier individuals with diversified income sources or existing property equity have a distinct advantage. This widening disparity transforms homeownership from a universal aspiration into a privilege for the financially secure.

Exploring Innovative Solutions

Amid the challenges, new pathways to homeownership are emerging. Rent-to-own programmes offer a bridge for renters to gradually build equity, while modular and prefabricated homes provide cost-effective alternatives that prioritise efficiency and affordability.

Community land trusts, which allow homeowners to purchase properties while leasing the land at reduced rates, present another innovative solution to address affordability. While these options are promising, they remain limited and highlight the need for creative approaches to navigate today’s complex housing market.

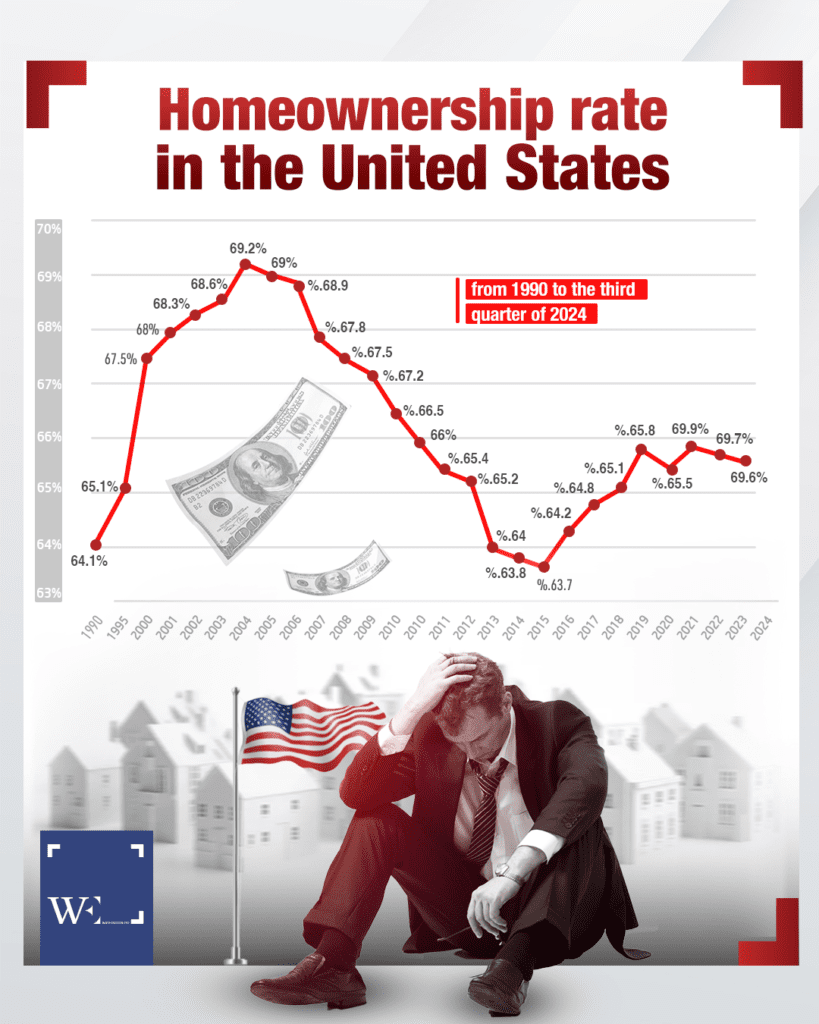

The Numbers Tell the Story

The data paints a stark picture of the shifting U.S. housing landscape. Mortgage rates, while down from their 7.79% peak in late 2023 to 6.08% in September 2024, remain significantly higher than historic lows. Homeowners with pre-2022 fixed-rate mortgages are reluctant to sell, contributing to a persistent supply shortage. Median home prices reached $416,700 in August 2024, marking 14 consecutive months of year-over-year increases.

On the construction front, rising material costs and labour shortages have hindered new development, further perpetuating affordability challenges. Alarmingly, 38% of U.S. households now believe homeownership is no longer central to the American Dream, signalling a cultural and economic shift in how Americans perceive housing.

A Challenging Future

The U.S. housing market stands at a crossroads, shaped by rising interest rates, constrained supply, and deepening affordability issues. For many, the dream of homeownership remains elusive, giving way to a nation increasingly defined by renters, shared housing, and alternative living arrangements. As economic forces continue to evolve, the housing landscape will demand innovative solutions to bridge the growing divide between aspiration and reality.