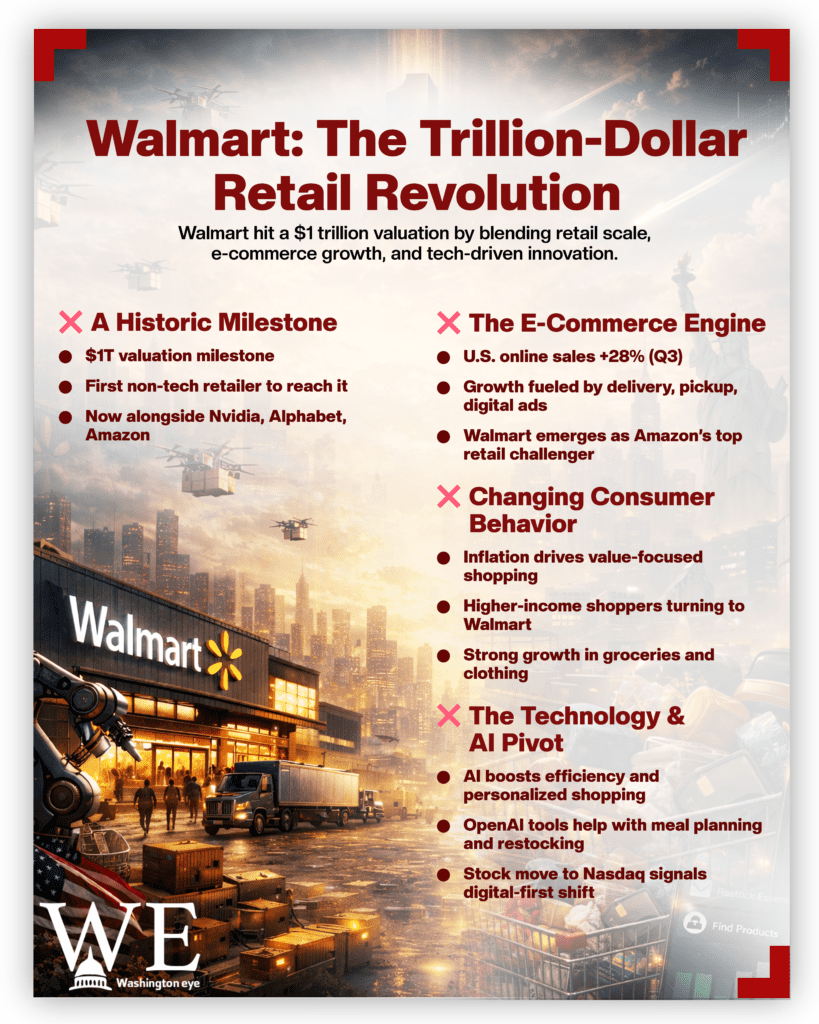

Walmart has made history by becoming the first traditional retailer to reach a $1 trillion market valuation, joining an elite group largely dominated by technology companies. The milestone highlights how the world’s largest brick-and-mortar retailer has reinvented itself, blending low-price retail with fast-growing digital capabilities.

A key driver behind Walmart’s surge has been the rapid expansion of its e-commerce business. Online sales in the US jumped 28% in the three months to the end of October, supported by strong demand for home delivery, curbside pickup, and digital advertising. While Amazon remains far ahead with a market value of about $2.6 trillion, Walmart’s online growth has positioned it as the most serious retail challenger to the tech giant.

Shifting consumer behaviour has also played to Walmart’s strengths. Persistent inflation and a cooling jobs market have pushed even higher-income households to seek better value. Walmart’s low-price reputation, combined with improved delivery speeds and a wider online assortment, has helped it attract shoppers across income brackets. Its most recent earnings update showed robust sales growth in essential categories such as groceries and clothing, underlining its resilience during economic uncertainty.

Wall Street enthusiasm has further been boosted by Walmart’s heavy investment in artificial intelligence. Investors see AI as central to the company’s future, helping it streamline operations, personalise shopping experiences, and grow its advertising business. In October, Walmart announced a partnership with OpenAI, allowing customers and Sam’s Club members to plan meals, restock essentials, and discover products through chat-based tools. This move reinforced the perception that Walmart is no longer just a retailer, but an emerging tech-driven platform.

Walmart has also weathered the impact of US tariffs better than many competitors. Although import taxes under President Donald Trump have raised prices on certain goods, including electronics and toys, executives say the company’s sheer scale and supply-chain power have helped soften the blow. “Walmart is better insulated than just about anybody given the value proposition we have,” chief financial officer John David Rainey previously noted.

Symbolically, Walmart’s decision to shift its stock listing from the New York Stock Exchange to the tech-heavy Nasdaq reflected its ambition to be seen as a digital-first company. The $1 trillion valuation was reached during the first week of John Furner’s tenure as chief executive, signalling strategic continuity rather than a sudden change in direction.

By crossing the trillion-dollar mark, Walmart has redefined what a traditional retailer can achieve, proving that scale, technology, and value pricing can coexist in the digital era.