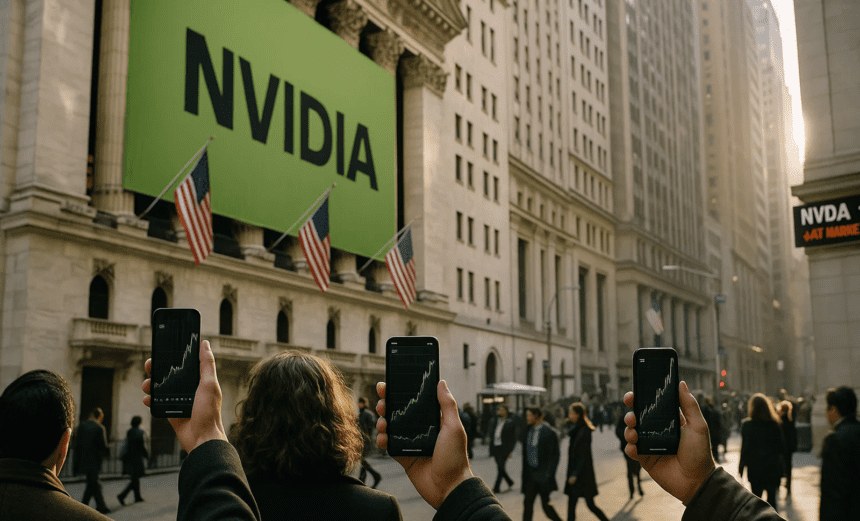

In a historic moment for global markets, Nvidia was officially crowned the world’s most valuable company on 25 June 2025, when its market capitalization surged past $4 trillion during trading on Wall Street, New York. The achievement places the California-based chipmaker at the very top of the global corporate hierarchy, surpassing Apple, Microsoft, and Saudi Aramco, and marking a major shift in technological and economic influence worldwide. The milestone reflects the explosive global demand for artificial intelligence (AI) hardware, as nearly every major AI model, from supercomputers to autonomous systems, depends on Nvidia’s cutting-edge processors.

The company’s meteoric rise was propelled by record-breaking quarterly performance and unprecedented global investment in AI infrastructure. In its latest earnings report, Nvidia announced over $60 billion in revenue and more than $30 billion in net profit, numbers rarely seen in the hardware industry. Demand for its flagship chips, H100, H200, and the Blackwell-series processors, has outpaced supply for nearly two years as governments, tech giants, and research institutions scramble to secure computing power for AI, robotics, climate modeling, surveillance systems, defense analytics, and digital governance platforms.

Founded on 5 April 1993 in Santa Clara, California, Nvidia began as a graphics company focused on gaming GPUs. Today, it commands roughly 85% of the global AI-chip market, an unprecedented level of dominance. The company was created by Jensen Huang, Chris Malachowsky, and Curtis Priem, but it is Jensen Huang, now one of the world’s wealthiest individuals with an estimated net worth of $120 billion, who has become the face of the AI hardware revolution. His strategic shift from gaming graphics to general-purpose GPU computing in the early 2000s is widely credited with setting the foundation for today’s AI boom.

The market reaction on 25 June 2025 was immediate and global. Stock indexes surged across Asia, Europe, and North America as investors rushed to capitalize on Nvidia’s momentum. Countries including the United States, China, Japan, South Korea, the UAE, India, Germany, and the UK have dramatically increased AI-related spending, making Nvidia a central player in national digital strategies. Analysts note that no other company in modern history has been as essential to the world’s computing infrastructure, with some governments treating Nvidia chips as “strategic assets” equivalent to oil reserves.

Nvidia’s dominance is reshaping global industries at a remarkable pace. In healthcare, its chips power diagnostic AI systems; in journalism and digital media, they support real-time content generation; in transportation, they enable self-driving platforms; in finance, they drive algorithmic trading and risk modeling; and in education, they support intelligent tutoring systems. The company’s technology also underpins advanced defense systems, cybersecurity networks, and smart-city infrastructure. As a result, its rise to $4 trillion is not seen as a temporary financial surge, but as a reflection of its central role in the technological fabric of the 21st century.

Experts argue that the company’s milestone marks the beginning of a new geopolitical era, one where access to high-performance chips determines economic competitiveness, scientific advancement, and even global security. Nvidia’s valuation symbolizes the power shift from traditional industries like oil and manufacturing toward the AI-driven digital economy. With its unmatched technological influence, the company is expected to shape global standards, supply chains, and innovation trends for years to come.