The post-Cold War financial system is entering a new and volatile phase, marked by fragmentation, contested liquidity, and strategic economic realignment. While the U.S. dollar remains the central artery of global finance, its dominance is no longer uncontested nor uniformly welcomed. As geopolitical blocs reconfigure and monetary alliances are tested, financial institutions and central banks are being forced to reassess longstanding assumptions—from access to dollar swap lines to the very nature of reserve assets.

The Shifting Ground Beneath the Dollar Liquidity Regime

At the heart of global financial stability lies the Federal Reserve’s dollar swap line network, a mechanism that ensures overseas institutions have access to emergency dollar funding during market stress. Historically extended to allied central banks—most notably in the Eurozone, Japan, and the UK—these lines are increasingly viewed not as apolitical technical backstops, but as geopolitically conditioned privileges.

Recent research underscores the growing anxiety among European officials about restricted access to dollar liquidity during crises, a scenario that could destabilize banks with dollar liabilities still accounting for nearly 17% of total funding.

This shift coincides with a declining presence of foreign buyers—especially foreign central banks—in the U.S. Treasury market, where their retreat has been offset by domestic money market funds and hedge funds. These actors offer liquidity but lack the geopolitical alignment or long-term orientation of official sector holders, raising concerns about volatility and backstop resilience.

Europe’s CBDC Bet vs. America’s Digital Decentralization

The European Central Bank’s response to these vulnerabilities has been a doubling down on its digital euro project. Advocates argue a central bank digital currency (CBDC) could enhance monetary autonomy and resilience. Yet scholars warn that such efforts, in isolation, risk being both technologically insufficient and geopolitically reactive. Without control over data, payment rails, or trade leverage, a digital euro might not offer the strategic latitude Europe seeks.

In contrast, the U.S. appears to be taking a market-oriented approach, embracing stablecoin innovation, greenlighting crypto-financial infrastructure, and seeking strategic tech partnerships, including recent deals with the UAE that link AI and digital assets.

China’s Alternative Financial Order: Infrastructure with Intent

While U.S. and EU strategies diverge, China is methodically constructing a parallel financial architecture aimed at reducing its exposure to the dollar-dominated system. At the center of this initiative are extensive bilateral renminbi (RMB) swap lines, now established with over 40 central banks, which allow participating countries to bypass the dollar in trade and crisis liquidity scenarios. Complementing this is the expansion of CIPS, China’s own cross-border payment messaging system, which offers an alternative to the Western-controlled SWIFT network and furthers transactional independence.

In parallel, China is aggressively advancing the rollout of its digital yuan (e-CNY)—a state-controlled central bank digital currency that enables programmable, trackable cross-border transactions and could serve as a cornerstone of a future regional settlement system. At the same time, the People’s Bank of China (PBoC) has been accelerating its accumulation of gold reserves, reducing reliance on U.S. Treasuries and signaling a pivot toward hard assets as strategic collateral.

Far from being reactive, these moves reflect a coherent and long-term strategy to establish financial sovereignty, deepen regional integration, and export a model of economic influence that is decoupled from Washington’s monetary tools. Together, they represent an assertive bid to rewire the circuits of global finance, offering alternatives to countries wary of the geopolitical strings attached to dollar access.

The Strategic Trilemma: Pick Two

In this evolving geopolitical and monetary landscape, nations face what analysts increasingly describe as a strategic trilemma: maintain access to dollar-based infrastructure, preserve independent economic policy, or avoid alignment in the U.S.–China rivalry. Only two objectives can be achieved at once.

This concept was noted by policy strategist Matthew Pines, who warned that growing conditionality around Fed swap lines, coupled with U.S. retrenchment from global security guarantees, could push nations to accumulate Treasuries for repo liquidity or seek non-dollar alternatives entirely. He suggests that the dollar is simultaneously “tightening and shrinking”—an unstable configuration that could produce unpriced systemic risks.

Toward a New Monetary Geography

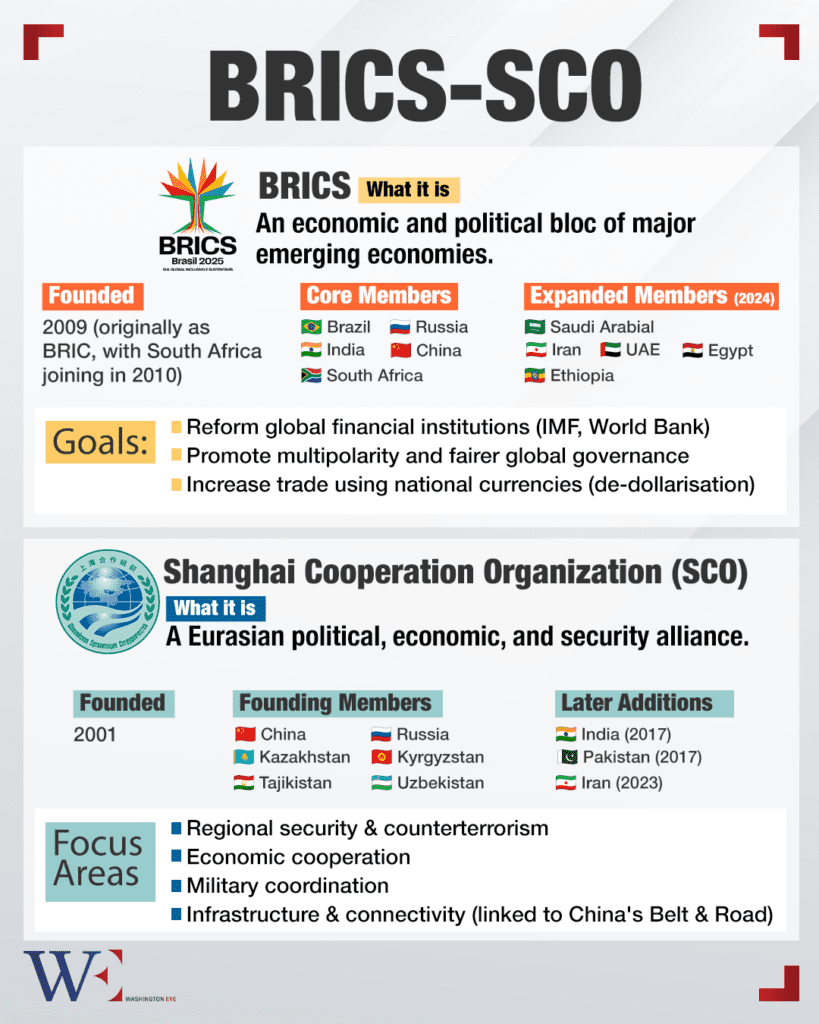

Historically, monetary zones have mirrored security zones. As the U.S. redefines its global defense posture, the map of monetary influence may contract in tandem. Emerging alliances—such as BRICS and the Shanghai Cooperation Organization—are working toward a post-dollar settlement framework, one that may rely on CBDCs, gold, and bilateral credit arrangements.

A Final Note

In this context, the dollar’s supremacy is no longer guaranteed by scale alone, but increasingly by strategy: access, infrastructure, and the perceived reliability of the U.S. as a monetary hegemon. The rules are changing—and for the first time in decades, so is the game board.