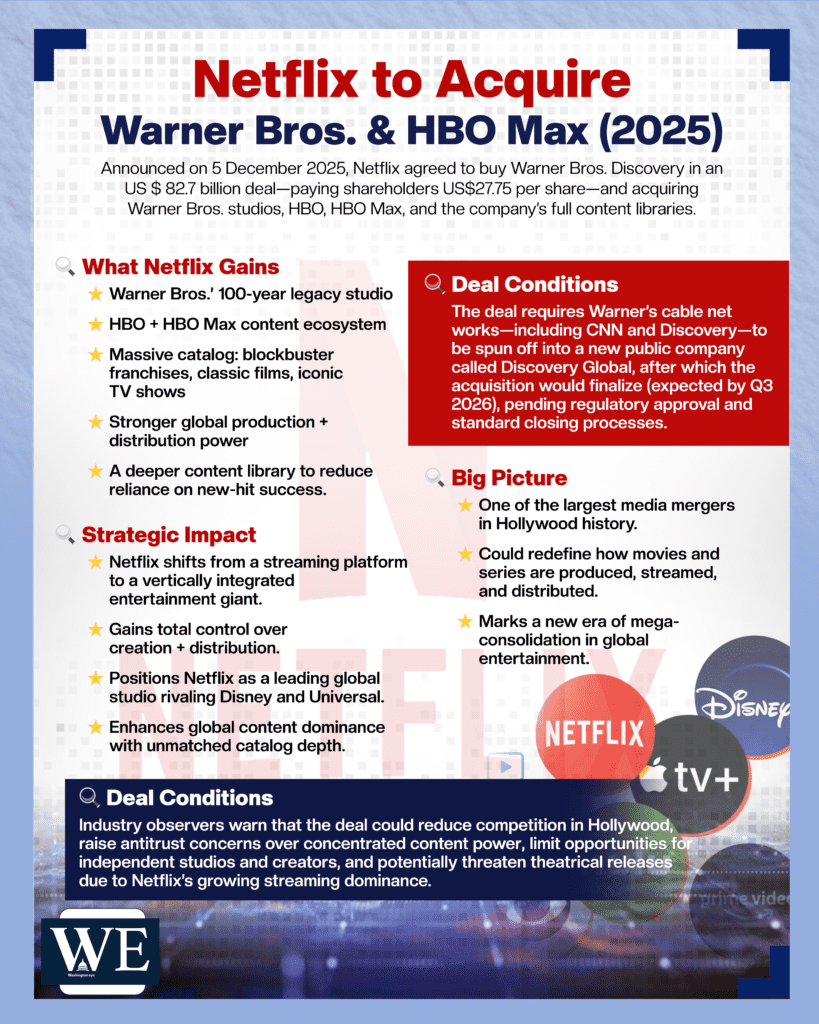

On December 5, 2025, Netflix and Warner Bros. Discovery announced a definitive agreement under which Netflix would acquire Warner Bros.’ film and television studios, including HBO and HBO Max, in a blockbuster cash-and-stock transaction. Under the terms, Warner Bros. Discovery shareholders will receive US$27.75 per share, valuing the equity at roughly US$72.0 billion, and including Warner’s existing debt, the total enterprise value of the deal comes to about US$82.7 billion. The transaction follows a heated bidding war in which Netflix outbid rivals such as Paramount, Skydance, and Comcast for control of Warner’s studios and streaming assets.

The assets Netflix is acquiring include Warner Bros.’ storied film and television studios, HBO and HBO Max (as well as their content libraries), and a vast catalog of intellectual property from blockbuster film franchises to classic movies and television shows. According to Netflix, the acquisition brings together two of “the greatest storytelling companies in the world,” combining Warner’s century-long legacy of world-class content with Netflix’s global scale, streaming infrastructure, and production capabilities. Netflix also pledged to maintain Warner Bros.’ existing operations, including theatrical film releases at least initially.

The deal is contingent on the spin-off of Warner’s “Global Networks”, its cable and linear-TV businesses (channels like Discovery Networks, CNN, etc.), into a separate publicly traded company (to be called Discovery Global), which is expected to complete in the third quarter of 2026. Once that spin-off is finished (and subject to regulatory approval and typical closing conditions), the acquisition would become final.

Strategically, the deal represents a major shift in the entertainment industry: by acquiring Warner Bros., Netflix transforms itself from primarily a streaming/distribution and original-production company into a vertically integrated media powerhouse, one that owns legacy studios, a deep back catalog of films and shows, and modern streaming infrastructure. For Netflix, this means gaining a massive library of proven content (from classic films to global franchises) to complement its originals, reducing “hit-rate” risk, and expanding its global content offering.

However, the acquisition has already sparked concerns. Industry groups, theater operators, and antitrust regulators warn that combining two of the biggest content and distribution players could threaten competition, limit content diversity, and reduce opportunities for independent studios. Critics argue the deal might undermine theatrical movie releases, concentrate media power, and harm creative freedom in Hollywood.

For viewers, the move could lead to a “one-stop” global entertainment platform, giving access to Netflix originals, Warner Bros. films and TV shows, HBO content, and major global franchises, under Netflix’s umbrella. For creators and the wider entertainment ecosystem, it’s a pivot: while Netflix promises to leverage Warner’s production capabilities and invest in creativity, the balance of power is shifting, with fewer large independents and more consolidation.

In short, Netflix’s acquisition of Warner Bros., including HBO Max and its content library, marks one of the biggest shake-ups in the history of Hollywood and streaming. If regulators approve it, this deal could reshape how films and series are produced, distributed, and consumed around the globe.