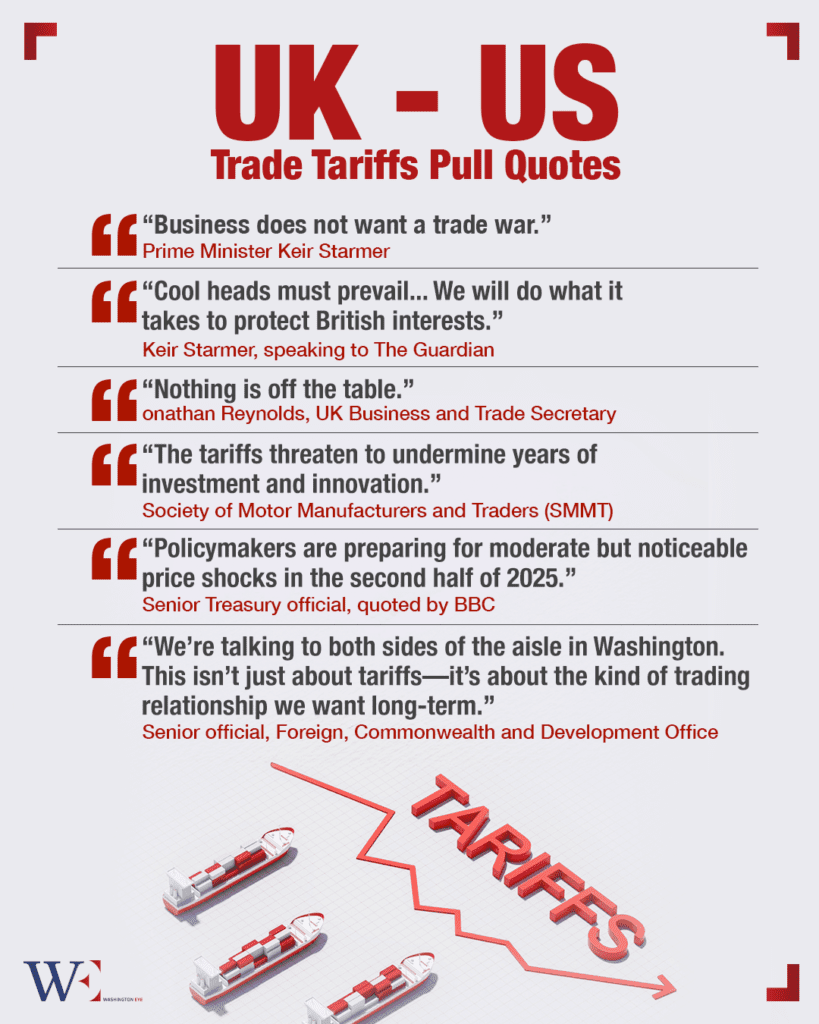

In a move that has reignited trade tensions across the Atlantic, U.S. President Donald Trump has announced sweeping tariffs on foreign imports—targeting key allies including the United Kingdom. The new measures, dubbed the “Liberation Day Tariffs,” include a 10% tariff on all UK imports and a 25% levy on foreign-manufactured vehicles. The announcement, made on April 2nd, has sparked immediate concern among UK officials, businesses, and economists, who warn the tariffs could seriously disrupt British industry and consumer prices.

While the UK government has urged calm, it is also actively drafting a list of U.S. products that could face retaliatory tariffs if negotiations fail to reverse the American measures. The moment marks a critical test for Prime Minister Keir Starmer’s foreign economic strategy and post-Brexit vision of “Global Britain”.

Starmer Urges Calm, But Signals UK Will Defend Itself

Speaking on April 3, Prime Minister Keir Starmer sought to temper talk of a full-blown trade war. “Business does not want a trade war,” Starmer said during a press Q&A, advocating for a diplomatic and proportionate approach to resolving the dispute. He emphasized that “cool heads must prevail,” but also hinted that the UK would not remain passive: “We will do what it takes to protect British interests”.

Starmer’s careful wording reflects the government’s desire to maintain stability while leaving room for escalation if required.

UK Trade Secretary: “Nothing Is Off the Table”

Business and Trade Secretary Jonathan Reynolds adopted a more pointed tone when stating that while the U.S. remains “our closest ally,” the UK must be prepared to act decisively. “Nothing is off the table,” Reynolds said, confirming that officials are preparing a comprehensive list of American goods for potential retaliatory tariffs.

Among the sectors under review are agriculture, consumer electronics, and luxury goods—industries where targeted retaliation could send a clear message to Washington while minimizing harm to UK consumers.

Auto Industry Braces for Heavy Hit

The UK’s automotive sector, already contending with post-Brexit regulatory shifts, may be among the hardest hit. Trump’s 25% tariff on foreign vehicles could have devastating consequences for British carmakers. According to internal government estimates up to 25,000 UK manufacturing jobs could be at risk if exports to the U.S. sharply decline.

The Society of Motor Manufacturers and Traders (SMMT) issued a statement warning that the tariffs threaten to “undermine years of investment and innovation” in one of the UK’s most strategically important industries.

Consumers Could Feel the Pinch

The economic fallout isn’t limited to manufacturers. UK consumers may also be affected, especially if the standoff escalates into broader tit-for-tat measures. Analysts at the Resolution Foundation note that U.S. imports—ranging from tech gadgets to food and medicine—could rise in price, feeding inflation and straining household budgets.

A senior Treasury official anonymously noted that policymakers are preparing for “moderate but noticeable price shocks” in the second half of 2025 if the tariffs are sustained.

Northern Ireland Caught in the Crossfire

Northern Ireland, with its dual regulatory framework under the Windsor Framework, faces a uniquely complex situation. As part of the UK but closely integrated with EU trade rules, it could find itself indirectly affected by both US-UK and EU-US trade tensions. Stormont ministers have reportedly requested briefings from Westminster to model sector-by-sector impacts.

Diplomatic Backchannels and Future Risks

While President Trump’s White House maintains that the tariffs are necessary to “rebalance unfair trade,” UK diplomats are working through backchannels in Washington to make the case for exemptions. The UK had been making quiet progress on laying the groundwork for a post-Brexit free trade agreement with the U.S.—talks now thrown into uncertainty.

A senior official from the Foreign, Commonwealth and Development Office told Sky News: “We’re talking to both sides of the aisle in Washington. This isn’t just about tariffs—it’s about the kind of trading relationship we want long-term”.

What Happens Next?

As of this week, the UK’s response remains fluid. The Department for Business and Trade is finalizing a set of contingency measures, including retaliatory tariffs, emergency support for exporters, and new trade alignment options with the EU and Asia-Pacific markets.

With Trump making clear that these tariffs are just the “first phase” of a broader trade realignment, UK policymakers may have to prepare for sustained economic friction.