As trade hostilities between the United States and China deepen in 2025 under President Donald Trump’s renewed tariffs, China has turned to one of its most potent yet underappreciated weapons: rare earth elements. These obscure minerals, while rarely discussed outside industrial or scientific circles, are essential to the modern economy. From smartphones and electric vehicles to missile systems and MRI machines, rare earths are foundational to the technologies that power the 21st century. Unlike tariffs or duties, this is a front where China holds a commanding advantage—and where the U.S. faces steep obstacles to retaliate in kind.

What Are Rare Earths?

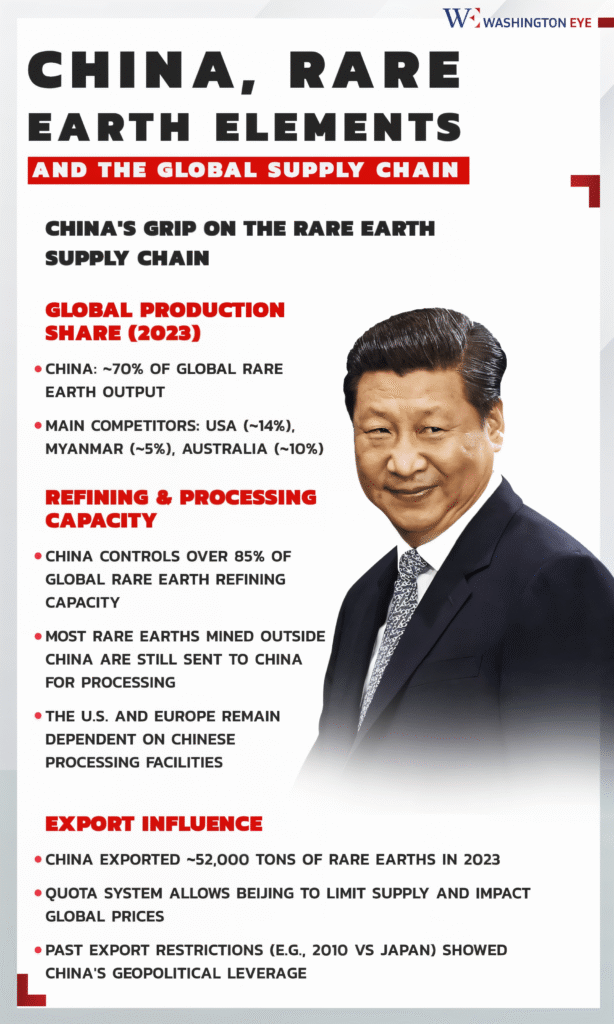

Rare earth elements comprise a group of seventeen metals that, despite their misleading name, are relatively abundant in the Earth’s crust. However, their extraction and refining are incredibly difficult, environmentally hazardous, and financially intensive. While the United States does have some deposits, it has long been dependent on China for the refined materials. According to the International Energy Agency, in 2023 China accounted for 61 percent of global mined rare earth output and a staggering 92 percent of the global processing capacity. This means that even if raw materials are mined elsewhere, they are typically shipped to China for refinement—a choke point Beijing controls with surgical precision.

These materials are essential in the production of permanent magnets that power the motors of electric vehicles and wind turbines, the data storage systems in hard drives, and even the compact engines used in consumer electronics. They are also critical to the defense industry, where they are embedded in guidance systems, jet propulsion, sonar arrays, and advanced medical technologies like MRI scanners.

April 2025: Beijing Pulls the Rare Earth Lever

Earlier this month, in direct response to President Trump’s imposition of a 34 percent tariff on a wide range of Chinese goods, the Chinese government enacted export restrictions on seven types of rare earths, specifically those used in high-performance magnets. These rules require all exporters to secure government licenses for these minerals and for any product containing even trace amounts of them. According to industry sources, including John Ormerod, founder of the rare earth consultancy JOC, shipments destined for American and European firms have already been halted while exporters scramble to understand and comply with the new licensing requirements.

The restrictions focus primarily on heavy rare earth elements, which are rarer than their lighter counterparts, more valuable on a per-kilogram basis, and significantly more difficult to separate and refine. These elements are indispensable for manufacturing the ultra-compact, high-strength magnets used in advanced electronics, military-grade equipment, and green energy applications. Joshua Ballard, CEO of USA Rare Earth, noted that China controls 98 percent of global heavy rare earth production. As a result, U.S. companies reliant on these materials for defense and tech production must now seek permission from the very government they are strategically opposing.

How Did China Corner the Market?

China’s dominance of this sector was not built overnight. Although rare earth mining in China began as early as the 1950s, it wasn’t until the late 1970s and 80s that the industry gained momentum. Leveraging low labor costs, loose environmental regulations, and imported refining technology—much of it originally developed in the United States, Japan, and Europe—China built a vertically integrated supply chain. It mastered not only the extraction of rare earths but the ability to refine, manipulate, and mass-produce the components essential to high-tech manufacturing. This long-term investment strategy was underscored in 1992 by former leader Deng Xiaoping, who famously declared, “While there is oil in the Middle East, China has rare earths”. Today, that prophecy is fulfilled.

The United States, once a pioneer in rare earth development, gradually ceded the market. As China ramped up its output, American firms found themselves unable to compete on cost. According to Ormerod, not only did these companies lose their competitive edge—they lost institutional knowledge and skilled labor. Once American manufacturing began to shutter its rare earth facilities, there was no easy path back. Meanwhile, China scaled up, modernized its refineries, and benefited from economies of scale and generous government subsidies. Between 2020 and 2023, 70 percent of all U.S. imports of rare earth compounds and metals came directly from China, according to a recent U.S. Geological Survey report.

Strategic Disruption, Surgical Strike

This isn’t China’s first use of rare earths as leverage. In 2010, it suspended shipments to Japan over a maritime dispute. More recently, it banned rare earth refining technology exports in 2023, a move designed to slow down competitors’ ability to catch up. Today, the strategy has evolved into something more precise. Rather than blanket bans, the Chinese government is deploying highly targeted restrictions—focusing on magnets, alloys, and high-purity derivatives that are fundamental to advanced technologies.

This approach hits particularly hard in sectors that depend on ultra-specialized components: aerospace, automotive, semiconductor manufacturing, and precision defense technologies. As economist Justin Wolfers told reporters, China is demonstrating its capacity to “exert incredible economic might by being strategic and surgical”.

Trump’s Executive Reaction: The Critical Minerals Probe

In response to these developments, President Trump signed an executive order to launch a national security investigation into America’s reliance on imported critical minerals. His statement cited growing concerns over the vulnerability of U.S. supply chains, warning that this dependency could jeopardize national defense readiness, price stability, and broader economic resilience. While Trump’s administration continues to wield tariffs as a primary instrument of pressure, this executive action acknowledges the deeper industrial threat posed by China’s rare earth grip.

Is the U.S. Ready to Compete?

The Biden administration, and now Trump’s second term, have poured hundreds of millions into domestic rare earth initiatives. Since 2020, the Department of Defense has invested over $439 million in rare earth development projects with the goal of achieving a self-sustaining mine-to-magnet supply chain by 2027. Some American firms are beginning to gain ground. Phoenix Tailings, a Massachusetts-based startup, has developed a clean technology process for refining rare earths without waste or emissions. The company currently produces 40 metric tons of rare earth alloys annually and plans to expand tenfold with a new facility in New Hampshire. Similarly, USA Rare Earth is constructing a plant in Texas that will eventually manufacture 5,000 tons of rare earth magnets each year. The company also owns a heavy rare earth deposit in West Texas containing all the elements targeted by China’s latest restrictions.

Still, challenges remain formidable. While the U.S. has raw materials and promising startups, it lacks the commercial-scale infrastructure and industrial workforce needed to process rare earths at competitive prices. The technological processes, environmental clearances, and capital requirements involved are immense. Even with federal support, industry leaders acknowledge that catching up to China could take years—if not a decade.

A New Cold War?

The rare earth battle is not merely an economic skirmish. It is part of a broader geopolitical contest over technological supremacy, resource security, and strategic autonomy. Control over rare earths increasingly means control over the future of clean energy, artificial intelligence, autonomous vehicles, and next-generation defense systems. By asserting dominance through these latest export controls, China is not just retaliating against U.S. tariffs—it is signaling its industrial confidence and geopolitical maturity.

The United States now faces a stark choice: either rebuild the supply chains it dismantled decades ago or continue operating at the mercy of a rival superpower that has mastered the art of converting obscure minerals into strategic leverage.