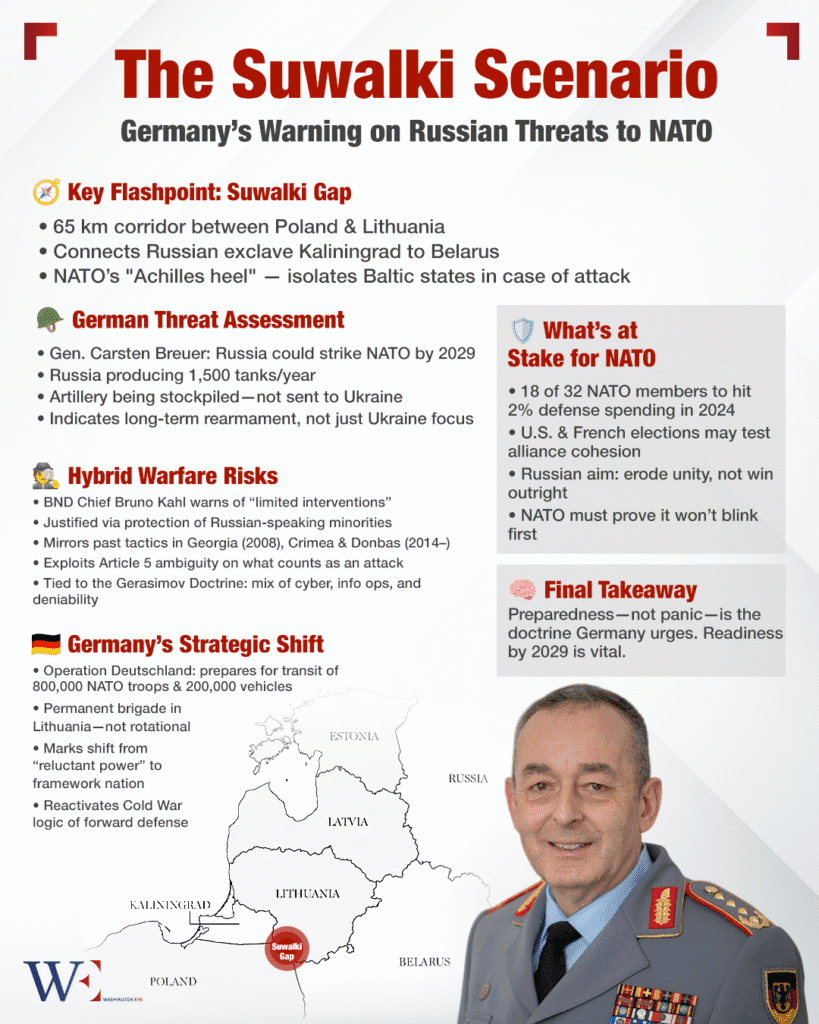

The recent warning from General Carsten Breuer, Germany’s Chief of Defense, that Russia could strike NATO within the next four years is not merely a theoretical exercise. It’s a calculated projection, based on visible trends in Moscow’s military posture. Russia’s production of approximately 1,500 tanks annually—paired with stockpiling of artillery shells withheld from Ukraine—suggests that the Kremlin is preparing for more than a protracted war of attrition. It’s preparing for escalation.

One likely target is the Suwalki Gap, a 65-kilometer corridor linking Belarus and Russia’s Kaliningrad exclave through Poland and Lithuania. Any aggression here could sever the Baltic states from NATO reinforcements, isolating them strategically. The vulnerability of this corridor has long been noted by analysts at RAND and other institutions. That Berlin is now emphasizing it as a frontline risk only underscores how rapidly the security calculus in Europe is changing.

Russia’s Toolkit: Limited War, Maximum Impact

Germany’s foreign intelligence chief, Bruno Kahl, adds another dimension to the threat: the use of limited interventions to protect Russian-speaking minorities abroad. This has precedent in Georgia (2008), Crimea (2014), and Donbas (since 2014). Such operations are designed to fall below NATO’s Article 5 threshold, sparking political paralysis rather than armed response.

These actions are rooted in the so-called Gerasimov Doctrine, a hybrid strategy mixing cyber warfare, disinformation, conventional force, and plausible deniability. Russia’s real weapon may not be its tanks—but NATO’s internal divisions. Disrupt political unity, and NATO’s military strength becomes functionally inert.

Germany’s Awakening: No Longer a Reluctant Actor

In response, Germany is undergoing a major doctrinal shift. The Bundeswehr’s “Operation Deutschland” is revamping Germany’s role as NATO’s logistical backbone. Berlin is preparing for the transit of 800,000 troops and 200,000 vehicles through its territory in case of conflict. Furthermore, Germany has committed a permanent brigade in Lithuania—a stark break from NATO’s traditional rotational deployments.

This is more than symbolism. It signals Germany’s transformation from a post-war pacifist actor into a central pillar of Europe’s forward defense posture. Historically accused—especially by Washington—of underdelivering on defense, Berlin now aims to become a “framework nation” anchoring NATO’s eastern front.

Trump’s Return: A NATO Ally, or Wild Card?

President Donald Trump’s second term has upended traditional assumptions about U.S. foreign policy. In recent months, Trump has issued sharp warnings to NATO members, insisting that those who fail to meet the 2% defense spending benchmark “shouldn’t expect automatic protection.” In one public comment, he even suggested that he would “encourage Russia to do whatever they want” to those nations not pulling their weight—sending shockwaves through European capitals.

Trump has also attempted, and failed, to mediate a peace deal between Ukraine and Russia. In early 2025, he proposed a 30-day ceasefire. Ukraine signaled acceptance, but Moscow rejected the framework outright, instead demanding NATO rollbacks and territorial concessions. Following this failure, the Trump administration froze additional U.S. military aid to Ukraine, citing lack of progress and accusing President Volodymyr Zelenskyy of acting in bad faith.

This has alarmed traditional allies and emboldened adversaries. While Trump insists he’s preventing “forever wars,” European leaders now question whether the U.S. remains a fully reliable partner in the collective defense architecture it once built.

European Response: Building Strategic Redundancy

In the face of American unpredictability, Europe is seeking new avenues for defense coordination. France, Germany, Poland, the UK, and Italy have moved forward with the “Weimar+” initiative, aiming to develop rapid deployment capabilities and policy alignment independent of U.S. influence. The European Union, long hesitant on defense, is fast-tracking measures to support industrial-scale weapons production and digital defense infrastructure.

NATO still benefits from superior command integration and intelligence sharing, but political unity remains its Achilles heel. Russian planners are likely factoring this into any future calculus.

The Window to Act Is Closing

The broader takeaway from Germany’s military leadership is not that war with Russia is inevitable—it’s that the opportunity to deter it is shrinking. With eighteen of NATO’s thirty-two members expected to meet the 2% defense threshold in 2025, material readiness is improving. But readiness is not just about weapons and soldiers. It’s about credibility, cohesion, and clarity of purpose.

President Trump’s transactional approach to alliances has created doubt. His admiration for Putin, coupled with a willingness to sideline Ukraine, reinforces the perception that American resolve is conditional. That perception alone may be enough for Russia to probe NATO’s red lines—economically, politically, and militarily.

A Doctrine of Deterrence, Not Delay

Germany’s message is clear: by 2029, NATO must be ready—not reactive. That means refining command structures, reinforcing vulnerable territories like the Baltics, and reestablishing a unified front in transatlantic relations. If Russia’s bet is that NATO will falter, then NATO’s response must be more than statements—it must be demonstrable deterrence.

The clock is ticking. And in a world where strategic ambiguity benefits the aggressor, clarity and cohesion are NATO’s most powerful weapons.